Business & Money

KCB Secures €30 Million to Boost Women-Led Businesses in Kenya

Kenya Commercial Bank CEO Paul Russo summarised the broader impact: “The success of this program will go beyond financial numbers. It’s about changing lives, empowering women, and ensuring that they play a pivotal role in Kenya’s economic future.”

KCB receives €30M to support women entrepreneurs in Kenya, offering loans and mentorship to startups. Apply now and access growth funding for your business.

By Charles Wachira

In a major step towards empowering women entrepreneurs in Kenya, the Kenya Commercial Bank (KCB) received €30 million (approximately KSh 4.2 billion) in April 2024.

This significant funding was granted by the Bill & Melinda Gates Foundation in partnership with the European Investment Bank (EIB), aimed at advancing women-led businesses and startups across the country.

Supporting Women Entrepreneurs: The Inception

The grant was a targeted effort to fill the long-standing financial gap that women in business often face, especially in Kenya’s rapidly growing economy.

Recognizing the potential that lies in women entrepreneurs and startups, the initiative was structured to help create more sustainable and impactful business environments, allowing more women to access the capital necessary to start or scale their businesses.

Speaking on the funding, KCB’s Chief Executive Officer Paul Russo highlighted the bank’s commitment to advancing financial inclusion and specifically empowering women-led businesses.

He noted, “This partnership is more than just a funding mechanism. It is a platform to give women the financial tools and support they need to thrive in a competitive economy. We see the untapped potential in women entrepreneurs and are committed to breaking down barriers to ensure they can access the capital and financial literacy they need to succeed.”

The Significance of the Fund

The €30 million grant is designed to provide a mixture of soft loans, grants, and credit guarantees to women entrepreneurs.

The loans, which will come with preferential interest rates and flexible repayment terms, are aimed at encouraging more women to formalize their businesses, enter competitive markets, and drive innovation.

Werner Hoyer, President of the European Investment Bank, expressed excitement about the collaboration: “We are proud to support Kenya’s thriving entrepreneurial landscape through this initiative. Women-led businesses are critical to the country’s economic future, and through this fund, we aim to eliminate the financial hurdles these entrepreneurs face. This investment is more than just a financial contribution; it is an investment in Kenya’s socio-economic growth.”

How to Access the Funds

Access to these funds has been structured to ensure inclusivity and transparency. Women entrepreneurs interested in applying for the loans can do so through KCB’s online platform or by visiting any of their branches nationwide.

Additionally, KCB will host a series of workshops and seminars across Kenya to help women understand the lending process, provide business training, and guide them on how to best utilize the available resources.

The application process is streamlined to encourage participation. Applicants must provide:

- A viable business plan or a solid expansion strategy for existing businesses.

- Proof of business registration (for established enterprises).

- Clear identification and verification documents.

- A sound understanding of their business finances.

KCB’s Director of Women Banking, Dr. Ann Mutahi, emphasized the bank’s focus on inclusivity, stating, “We want to make sure that no one is left behind. Whether you are a woman just starting your business journey or have been running a business for years, we are here to offer financial and advisory support. Our goal is to enable women to grow their businesses, create jobs, and contribute meaningfully to Kenya’s economic development.”

Disbursement of the Funds

The funds are to be disbursed in phases, ensuring that as many women as possible benefit from the program. KCB will be offering loans of up to KSh 10 million for startups and up to KSh 50 million for more established enterprises that demonstrate significant growth potential.

This tiered approach ensures that small and large businesses alike can access the capital they need to thrive.

Additionally, a portion of the funds has been earmarked for startup incubation programs, which will provide young women entrepreneurs with mentorship, training, and access to networks, helping them build scalable and sustainable businesses.

According to a statement from the Bill & Melinda Gates Foundation, “Our collaboration with KCB and the EIB represents our commitment to supporting innovative and impactful financial solutions that will transform the lives of women entrepreneurs.

We are confident that this fund will enable women across Kenya to not only grow their businesses but also become key players in the global marketplace.”

Challenges Women Entrepreneurs Face

While Kenya has made significant strides in supporting entrepreneurs, access to finance remains one of the most significant challenges faced by women in business.

According to data from the International Finance Corporation (IFC), the financing gap for women-owned businesses in Kenya stands at over KSh 80 billion annually. Women often face more stringent lending requirements, and their businesses are perceived as higher risk by financial institutions, despite many of them demonstrating robust business models and growth potential.

KCB, through its partnership with the Gates Foundation and EIB, hopes to bridge this gap and address the systemic financial barriers that disproportionately affect women.

Voices from Beneficiaries

One of the early beneficiaries of the fund, Mary Wambui, who runs an agro-processing startup, expressed her gratitude for the initiative: “I have always struggled to get the capital to scale my business. With this funding, I was able to expand my operations and hire more staff. KCB has given me a lifeline and the confidence to push my business further.”

Another entrepreneur, Grace Njeri, who owns a clothing line, shared similar sentiments: “I had reached a point where I thought my business was stagnant, but this program has opened doors I never thought possible. It’s not just the money; it’s also the mentorship and business development support that has made the difference.”

Lessons for Aspiring Entrepreneurs

As this funding continues to empower more women, the key lesson from the initiative is the importance of financial literacy, mentorship, and access to capital.

Entrepreneurs must be prepared with clear business plans and strategies that demonstrate both short-term and long-term potential.

CEO Paul Russo summarized the broader impact, saying, “The success of this program will go beyond financial numbers. It’s about changing lives, empowering women, and ensuring that they play a pivotal role in Kenya’s economic future.”

Conclusion

The €30 million fund provided to KCB by the Bill & Melinda Gates Foundation and the European Investment Bank is a landmark step toward achieving gender parity in Kenya’s entrepreneurial landscape. By breaking down financial barriers and providing women with the resources and support they need, KCB is helping to unlock the potential of women entrepreneurs, who are crucial to the nation’s economic growth and development. Through this initiative, KCB aims to contribute to building a more inclusive and prosperous Kenya, where women-led businesses can thrive.

Keywords:Women entrepreneurs:KCB funding:Business loans:Startup growth:Kenya

Business & Money

Ethiopia Attracts $53.5 Million in Q1 Investments, Creates 8,700 Jobs

: Ethiopia attracts $53.5M in Q1 investments, creating 8,700 jobs. Growth driven

by reforms, with a focus on service and manufacturing sectors.

The Addis Ababa Investment Commission (AAIC) announced a promising start to the

2023/24 fiscal year, with 612 investors registering a combined capital of Birr 2.93 billion

($53.5 million) in the first quarter.

This reflects a 13% growth compared to the same period last year, signalling sustained

investor confidence despite economic challenges.

Speaking at a press briefing on November 30, AAIC’s Director of Communication,

Meseret Woldemariam, credited the growth to policy reforms and enhanced investor

facilitation.

“Our efforts to streamline investment processes and resolve bottlenecks are yielding

results. We remain committed to ensuring investors thrive in Addis Ababa,” she said.

SECTORIAL CONTRIBUTIONS

The majority of the newly licensed investors are in the service and manufacturing

sectors. The service sector includes hotels, tourism, and IT ventures, while the manufacturing

investments span electrical products, steel, wood, and textiles.

These investments have generated 8,707 jobs, comprising 770 permanent and 490

temporary positions created by newly licensed entities.

The AAIC has also initiated field monitoring visits to ensure operational readiness. “Our

team works closely with new investors to address challenges promptly, enabling faster

project rollout,” Meseret added.

CHALLENGES AND REFORMS

Investors continue to face hurdles such as foreign currency shortages and workspace

availability. However, the commission highlighted progress due to macroeconomic reforms,

particularly improving foreign currency access.

“We are actively collaborating with the Mayor’s office to address workspace issues

through professional support in rental solutions and operational guidance,” Meseret

explained.

Recent reforms in the National Bank of Ethiopia’s foreign exchange policy have also

been pivotal. In October, the central bank announced a 30% increase in forex allocation to priority sectors, a move welcomed by stakeholders.

EXPANSION PLANS AND PROJECTIONS

The AAIC aims to capitalise on the momentum, targeting Birr 15 billion ($274 million) in

investments by the end of the fiscal year. A new digital investment portal, launched in November, promises to reduce registration times by 40% and improve transparency.

“We are confident these initiatives will not only attract more investors but also deepen

the trust of existing ones,” Meseret concluded.

INVESTOR SENTIMENT

Prominent business leader Ahmed Yusuf, who recently launched a $3 million IT hub in

Addis Ababa, praised the commission’s efforts.

“The improvements in investor services and forex allocation are encouraging. We hope

to see more streamlined processes for licensing and operations,” he remarked.

As Ethiopia seeks to position itself as a regional investment hub, sustained efforts in

addressing investor concerns and enhancing infrastructure will be critical.

Business & Money

Ethiopia Eyes December Debt Restructuring After IMF Review

: Ethiopia’s December IMF review may unlock long-awaited debt restructuring,

crucial for economic reforms and stalled projects like the Koysha Hydroelectric

Dam.

Ethiopia’s much-anticipated debt restructuring prospects could gain clarity this

December, as the country awaits the second review under its four-year International

Monetary Fund (IMF) program.

The Extended Credit Facility (ECF), launched in August 2023, remains central to

Ethiopia’s economic reform and debt relief efforts.

Progress Toward Debt Treatment

Last week, Ethiopian authorities reached a staff-level agreement with the IMF tied to the

second review. A comprehensive report on this review is set for release in December, a month many stakeholders, including the National Bank of Ethiopia (NBE), view as pivotal for

advancing debt treatment plans.

“Debt restructuring stands at the centre of our reform agenda. With the report’s release,

we expect rescheduling talks to gain momentum,” said Habtamu Workneh, Director of

External Economic Analysis & International Relations at the NBE.

He added that discussions are focusing primarily on extending maturity dates for Ethiopia’s debts.

IMF Support and Engagements with Creditors

The IMF has provided Ethiopia with USD 2.5 billion under its current fiscal program,

offering critical support to the country’s macroeconomic stabilisation efforts.

In parallel, Ethiopian authorities have engaged with Eurobond holders and the Official

Creditors Committee (OCC).

A debt restructuring proposal was submitted to Eurobond holders in July 2024, following

key discussions in December 2023 and May 2024.

Additionally, a global investor update held on October 1, 2024, highlighted the nation’s

ongoing economic challenges and progress in creditor negotiations.

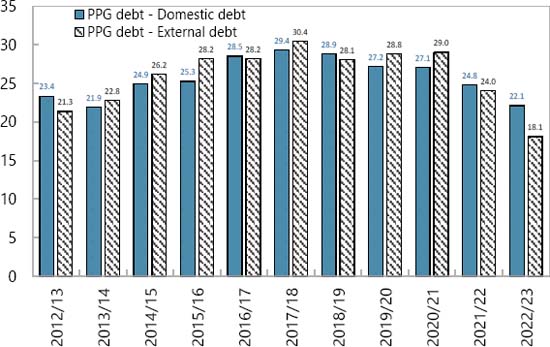

Shifting Debt Landscape

The government has reported improvements in its debt profile. Planning and Development Minister Fitsum Assefa (PhD) announced that Ethiopia had ceased relying on commercial loans and direct borrowing from the central bank.

She noted a significant drop in the external debt-to-GDP ratio to 13.7 per cent, though

the IMF’s Debt Sustainability Analysis, published in July 2024, pegged the ratio at 18

per cent as of June 2023.

External debt accounts for 45 per cent of Ethiopia’s total public and publicly guaranteed

debt, the report stated.

Financing Challenges Persist

Despite these reforms, Ethiopia’s financing challenges remain acute.

The government is seeking nearly USD 1 billion to complete the Koysha Hydroelectric

Dam project, which has stalled at two-thirds completion due to funding shortfalls.

The project is a critical component of Ethiopia’s development strategy, but its delays

underscore the broader fiscal pressures the country faces.

Expert Views on Economic Outlook

While Ethiopian officials are optimistic about the December review as a turning point,

analysts caution that real progress hinges on creditor consensus and the government’s

ability to implement reforms.

Critics have also raised concerns about inflated GDP growth figures, which they argue

may distort Ethiopia’s true debt sustainability.

Looking Ahead

The IMF review, coupled with Ethiopia’s active engagement with creditors, could mark a

a significant step forward in its quest for debt relief.

December will likely be a defining month for the country’s economic future, with broader

implications for its ability to attract investment and complete critical infrastructure

projects.

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

-

Business & Money9 months ago

Business & Money9 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics4 months ago

Politics4 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics3 months ago

Politics3 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics6 months ago

Politics6 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics6 months ago

Politics6 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics6 months ago

Politics6 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Business & Money2 months ago

Business & Money2 months agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?

-

Politics5 months ago

Politics5 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead