Business & Money

Standard Chartered’s 2023 Financial Success and HR Focus

Standard Chartered’s strong financial performance in 2023, coupled with its dedication to HR excellence, highlights the bank’s capability to thrive in a complex global environment. Standard Chartered maintains its position as a leader in the financial services sector by prioritizing skills development, progressive benefits, psychological safety, and effective change management.

: Standard Chartered’s Impressive 2023 Financial Results and HR Excellence Showcase the Bank’s Strength in a Complex Global Landscape, Focusing on Skills, Progressive Benefits, Psychological Safety, and Effective Change Management

By Charles Wachira

Standard Chartered, a UK-headquartered global banking giant, operates in 53 markets with 85,000 employees. In 2023, the bank reported a total operating income of $17.4 billion, a 10% increase from 2022, and a profit of $5.7 billion despite a challenging global economy.

Dr José Viñals, Group Chairman of Standard Chartered, highlighted the bank’s success in the latest financial report, attributing the impressive results to a clear strategy, discipline, and tireless execution led by Group Chief Executive Bill Winters and his management team.

UNLEASH interviewed Tanuj Kapilashrami, a key member of Standard Chartered’s C-Suite.

Formerly the bank’s CHRO, Kapilashrami transitioned to Chief Strategy and Talent Officer in April 2023. She emphasised the intersection of corporate strategy, people, talent, and the bank’s transformation agenda. Kapilashrami’s HR experience has always aligned with these areas, ensuring that the people and talent agenda supports the corporate strategy.

Standard Chartered’s 2023 results reflect the effectiveness of its strategy.

The bank achieved double-digit growth in key markets, marking a significant milestone.

Kapilashrami stressed that the people and culture agenda is vital to the bank’s performance and business strategy.

Dr. Viñals echoed this sentiment, noting that the Board and the Management Team are committed to maintaining the bank’s status as an employer of choice. The bank reported its highest employee net promoter score (25.86), up 8.31 points from 2022, indicating intense employee satisfaction and willingness to recommend working there.

In her interview with UNLEASH, Kapilashrami shared insights into Standard Chartered’s HR strategy. One key initiative is the bank’s transformation into a skills-first organisation.

This shift began in 2019 when strategic workforce planning revealed that advances in technology would render many jobs obsolete (“sunset jobs”) while creating new roles (“sunrise jobs”).

The bank found that reskilling and redeploying employees internally was more cost-effective than hiring externally. This approach also addressed the gender imbalance in emerging fields, supporting diversity and inclusion.

To facilitate this transformation, Standard Chartered has focused on future skills, both technical and human.

The bank has embraced a culture of learning, changing its learning platform to EdCast (now part of Cornerstone) and launching Future Skills Academies in areas like cybersecurity, data, and sustainability.

The bank also partnered with Gloat on an AI-powered talent marketplace, which matches employees to roles, projects, and gigs based on their skills. This marketplace has engaged 32,000 employees, with 26,000 using it to complete 2,500 projects.

Standard Chartered’s commitment to progressive benefits is another source of Kapilashrami’s pride.

The bank offers equalised parental leave globally, allowing parents to take leave regardless of gender or circumstances.

The policy has increased parental leave from two weeks to around eight weeks. Additionally, the bank provides menopause coverage through its insurance providers, emphasising its commitment to employee well-being in markets without national health systems.

Psychological safety is also a priority for Standard Chartered. The bank’s two-way feedback process has increased psychological safety by 20 percentage points.

This process ensures employees know where they stand and can develop and grow, which is linked to innovation, high performance, lower attrition, and more discretionary effort.

Kapilashrami highlighted the importance of effective change management in HR. She advised focusing on a few critical priorities with clear commercial benefits and co-creating the future of HR with employees. Standard Chartered uses continuous listening, supported by Qualtrics, to capture employee feedback and ideas. This approach was evident in the bank’s hybrid working strategy, which involved employees recreating watercooler moments and developing new ways of working.

In conclusion, Standard Chartered’s impressive 2023 financial results and commitment to HR excellence demonstrate the bank’s ability to navigate a complex global landscape. With a focus on skills, progressive benefits, psychological safety, and effective change management, the bank continues to set a high standard in the financial services industry.

Keywords:Standard Chartered Financial Growth:Skills-First Transformation:Employee Satisfaction and Well-being:Progressive Benefits Policy:Global Banking Strategy

Business & Money

Ethiopia Attracts $53.5 Million in Q1 Investments, Creates 8,700 Jobs

: Ethiopia attracts $53.5M in Q1 investments, creating 8,700 jobs. Growth driven

by reforms, with a focus on service and manufacturing sectors.

The Addis Ababa Investment Commission (AAIC) announced a promising start to the

2023/24 fiscal year, with 612 investors registering a combined capital of Birr 2.93 billion

($53.5 million) in the first quarter.

This reflects a 13% growth compared to the same period last year, signalling sustained

investor confidence despite economic challenges.

Speaking at a press briefing on November 30, AAIC’s Director of Communication,

Meseret Woldemariam, credited the growth to policy reforms and enhanced investor

facilitation.

“Our efforts to streamline investment processes and resolve bottlenecks are yielding

results. We remain committed to ensuring investors thrive in Addis Ababa,” she said.

SECTORIAL CONTRIBUTIONS

The majority of the newly licensed investors are in the service and manufacturing

sectors. The service sector includes hotels, tourism, and IT ventures, while the manufacturing

investments span electrical products, steel, wood, and textiles.

These investments have generated 8,707 jobs, comprising 770 permanent and 490

temporary positions created by newly licensed entities.

The AAIC has also initiated field monitoring visits to ensure operational readiness. “Our

team works closely with new investors to address challenges promptly, enabling faster

project rollout,” Meseret added.

CHALLENGES AND REFORMS

Investors continue to face hurdles such as foreign currency shortages and workspace

availability. However, the commission highlighted progress due to macroeconomic reforms,

particularly improving foreign currency access.

“We are actively collaborating with the Mayor’s office to address workspace issues

through professional support in rental solutions and operational guidance,” Meseret

explained.

Recent reforms in the National Bank of Ethiopia’s foreign exchange policy have also

been pivotal. In October, the central bank announced a 30% increase in forex allocation to priority sectors, a move welcomed by stakeholders.

EXPANSION PLANS AND PROJECTIONS

The AAIC aims to capitalise on the momentum, targeting Birr 15 billion ($274 million) in

investments by the end of the fiscal year. A new digital investment portal, launched in November, promises to reduce registration times by 40% and improve transparency.

“We are confident these initiatives will not only attract more investors but also deepen

the trust of existing ones,” Meseret concluded.

INVESTOR SENTIMENT

Prominent business leader Ahmed Yusuf, who recently launched a $3 million IT hub in

Addis Ababa, praised the commission’s efforts.

“The improvements in investor services and forex allocation are encouraging. We hope

to see more streamlined processes for licensing and operations,” he remarked.

As Ethiopia seeks to position itself as a regional investment hub, sustained efforts in

addressing investor concerns and enhancing infrastructure will be critical.

Business & Money

Ethiopia Eyes December Debt Restructuring After IMF Review

: Ethiopia’s December IMF review may unlock long-awaited debt restructuring,

crucial for economic reforms and stalled projects like the Koysha Hydroelectric

Dam.

Ethiopia’s much-anticipated debt restructuring prospects could gain clarity this

December, as the country awaits the second review under its four-year International

Monetary Fund (IMF) program.

The Extended Credit Facility (ECF), launched in August 2023, remains central to

Ethiopia’s economic reform and debt relief efforts.

Progress Toward Debt Treatment

Last week, Ethiopian authorities reached a staff-level agreement with the IMF tied to the

second review. A comprehensive report on this review is set for release in December, a month many stakeholders, including the National Bank of Ethiopia (NBE), view as pivotal for

advancing debt treatment plans.

“Debt restructuring stands at the centre of our reform agenda. With the report’s release,

we expect rescheduling talks to gain momentum,” said Habtamu Workneh, Director of

External Economic Analysis & International Relations at the NBE.

He added that discussions are focusing primarily on extending maturity dates for Ethiopia’s debts.

IMF Support and Engagements with Creditors

The IMF has provided Ethiopia with USD 2.5 billion under its current fiscal program,

offering critical support to the country’s macroeconomic stabilisation efforts.

In parallel, Ethiopian authorities have engaged with Eurobond holders and the Official

Creditors Committee (OCC).

A debt restructuring proposal was submitted to Eurobond holders in July 2024, following

key discussions in December 2023 and May 2024.

Additionally, a global investor update held on October 1, 2024, highlighted the nation’s

ongoing economic challenges and progress in creditor negotiations.

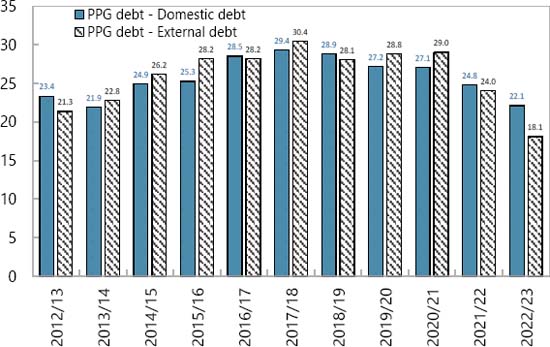

Shifting Debt Landscape

The government has reported improvements in its debt profile. Planning and Development Minister Fitsum Assefa (PhD) announced that Ethiopia had ceased relying on commercial loans and direct borrowing from the central bank.

She noted a significant drop in the external debt-to-GDP ratio to 13.7 per cent, though

the IMF’s Debt Sustainability Analysis, published in July 2024, pegged the ratio at 18

per cent as of June 2023.

External debt accounts for 45 per cent of Ethiopia’s total public and publicly guaranteed

debt, the report stated.

Financing Challenges Persist

Despite these reforms, Ethiopia’s financing challenges remain acute.

The government is seeking nearly USD 1 billion to complete the Koysha Hydroelectric

Dam project, which has stalled at two-thirds completion due to funding shortfalls.

The project is a critical component of Ethiopia’s development strategy, but its delays

underscore the broader fiscal pressures the country faces.

Expert Views on Economic Outlook

While Ethiopian officials are optimistic about the December review as a turning point,

analysts caution that real progress hinges on creditor consensus and the government’s

ability to implement reforms.

Critics have also raised concerns about inflated GDP growth figures, which they argue

may distort Ethiopia’s true debt sustainability.

Looking Ahead

The IMF review, coupled with Ethiopia’s active engagement with creditors, could mark a

a significant step forward in its quest for debt relief.

December will likely be a defining month for the country’s economic future, with broader

implications for its ability to attract investment and complete critical infrastructure

projects.

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

-

Politics5 months ago

Politics5 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Business & Money10 months ago

Business & Money10 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics4 months ago

Politics4 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics6 months ago

Politics6 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics7 months ago

Politics7 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics6 months ago

Politics6 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money2 months ago

Business & Money2 months agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?

-

Politics7 months ago

Politics7 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout