Business & Money

Equity Group Holdings Declares Record Kshs 15.1 Billion Dividend

Looking ahead, Equity Group is strategically positioned in East Africa, a rapidly growing region with significant economic potential. Its diversified business model—encompassing banking, insurance, health, technology, and philanthropy—empowers the group to capitalise on growth opportunities, foster innovation, and enhance service delivery for a promising future.

: The Equity Group is pioneering positive outcomes for all with its Africa Recovery and Resilience Plan, visionary leadership, and strategic positioning.

By Charles Wachira

Equity Group Holdings has proudly announced a proposed record dividend of Kshs 15.1 billion (US$ 116,884,751) for the second consecutive year, a significant achievement that underscores its robust financial performance in 2023.

Dr James Mwangi, Group Managing Director and CEO, emphasised, “The Kshs. 4 per share dividend amounts to a 36% payout of the Kshs. 43.7 billion (S$ 338,269,114) profit after tax, or Kshs 11.1 earnings per share, and a dividend yield of 11.9% on the 2023 year-end closing share price of Kshs. 33.65, or 800% on par value.”

The financial results for 2023 underscored strong momentum, with net interest income growing by 21% to Kshs 104.2 billion (US$806,582,190) from Kshs 86 billion (US$665,701,232) and non-funded income registering an impressive 30% growth to Kshs 75.9 billion (US$587,520,040) from Kshs 58.3 billion (US$451,283,509).

A 106% rise in lending related to trade finance and a 26% increase in trade finance guarantees and off-balance sheet items drove a 90% increase in gross trade finance revenue to Kshs.11 billion (US$85,147,832) from Kshs.5.8 billion (US$44,961.24).

However, total costs escalated by 52% to Kshs 128.2 billion (US$992,359,278) from Kshs 84.5 billion (U$654,090,164), primarily due to a 139% rise in loan loss provisions to Kshs 32.8 billion (US$23,895,353) from Kshs 13.7 billion (US$106,047,744), aimed at bolstering asset quality buffers.

The depreciation of the Kenyan shilling and high inflation also caused a 28% increase in staff costs and a 39% increase in other operating expenses.

The return on average equity stood at 22.3%, exceeding the 18% cost of capital.

Profit after tax decreased by 5% to Kshs 43.7 billion (US$338,269,114) from Kshs 46.1 billion (US$ 356,846,823), mainly due to a 53% increase in interest expenses compared to a 30% growth rate in interest income.

With a 29% increase in customer deposits to Kshs 1.358 trillion (US$10,511,886,896) from Kshs 1.052 trillion (US$8,143,229,024), the group’s gross balance sheet increased by 26% to Kshs 1.821 trillion (US$14,095,836,552).

Shareholders’ funds increased by 20% to Kshs 218.1 billion (US$ 1,688,249,287) from Kshs 182.2 billion ( US$ 1,410,357,726).

The deployment of funding saw net loans rise by 26% to Kshs.887.4 billion (US$6,869,107,828) from Kshs.706.6 billion (US$5,469,587,099), while government securities holdings grew by 27% to Ksh 500.5 billion (US$3,874,226,356.00) from Kshs.394 billion ( US$ 3,049,840,528)

Cash and cash equivalents increased by 25% to Kshs 290.1 billion ( US$ 2,245,580,551) from Kshs 232.4 billion ( US$ 1,798,941,468).

Equity Group has demonstrated remarkable resilience, navigating challenges such as interest rate capping, the COVID-19 pandemic, global supply chain disruptions, and volatile global economic conditions, including FX volatility, high inflation, and interest rates.

Over the past seven years, amidst these adversities, customer numbers have surged to 19.6 million from 10.4 million, customer deposits have risen to Kshs.1.358 trillion (US$10,511,886,896) from Kshs.303.2 billion ( US$2,346,983,878), and the loan book has grown to Kshs.887.4 billion ( US$ 6,869,107,828) from Kshs.269.9 billion ( US$ 2,089,218,168). Total assets have soared to Kshs.1.822 trillion ( US$ 14,103,577,264) from Kshs.428.1 billion ( US$ 3,313,798,807), while shareholders’ funds have climbed to Kshs.218.1 billion ( US$ 1,688,249,287) from Kshs.72.1 billion ( US$ 561,089,494), a testament to the group’s stability and resilience.

Said Dr. Mwangi, “ The Group has navigated these challenges through a deliberate and strategic approach, reinforced by a robust risk management governance framework and a strong organisational culture emphasising innovation, customer-centricity, compliance, and prudent risk management.”

The Group achieved a PAR of 11.7%, improving from 12.2% in the third quarter and outperforming the industry NPL ratio of 14.8%.

Dr. Mwangi also noted, “The proactive derisking strategy involved providing for the lifetime expected loss on outstanding NPLs and increasing loan loss provisions by 139% to Kshs 32.8 billion (US$253,895,353) from Kshs 13.7 billion ( US$106,047,754), resulting in a cost of risk of 4.4% and an increased NPL coverage of 67.3% without guarantees and 90% with guarantees.”

Motivated by a vital mission and a risk management culture, Equity Group has received recognition through awards like the Oslo Business for Peace Award.

In addition, Brand Finance has named it the second-strongest global banking brand.

The group maintains strong risk buffers, 53.4% liquidity, and excellent asset quality. Its total capital-to-risk-weighted asset ratio of 18.1% exceeds the regulatory requirement of 14.5%.

The core capital to risk-weighted asset ratio stood at 14.3%, comfortably above the regulatory threshold of 10.5%, positioning the group well for its growth strategy.

Looking ahead, Equity Group is strategically positioned in one of the world’s fastest-growing regions, East Africa, which boasts significant economic potential. With a diversified business model encompassing banking, insurance, health, technology, and philanthropy, the group is set to capitalise on growth opportunities, innovate, and enhance its service delivery, a promising outlook for the future.

Dr. Mwangi concluded, “With clarity on our Africa Recovery and Resilience Plan, strong leadership, and strategic positioning, Equity Group is uniquely positioned to deliver positive outcomes for all stakeholders.”

Keywords:Record Dividend: Financial Performance: Asset Quality:Balance Sheet Growth:

Business & Money

Ethiopia Attracts $53.5 Million in Q1 Investments, Creates 8,700 Jobs

: Ethiopia attracts $53.5M in Q1 investments, creating 8,700 jobs. Growth driven

by reforms, with a focus on service and manufacturing sectors.

The Addis Ababa Investment Commission (AAIC) announced a promising start to the

2023/24 fiscal year, with 612 investors registering a combined capital of Birr 2.93 billion

($53.5 million) in the first quarter.

This reflects a 13% growth compared to the same period last year, signalling sustained

investor confidence despite economic challenges.

Speaking at a press briefing on November 30, AAIC’s Director of Communication,

Meseret Woldemariam, credited the growth to policy reforms and enhanced investor

facilitation.

“Our efforts to streamline investment processes and resolve bottlenecks are yielding

results. We remain committed to ensuring investors thrive in Addis Ababa,” she said.

SECTORIAL CONTRIBUTIONS

The majority of the newly licensed investors are in the service and manufacturing

sectors. The service sector includes hotels, tourism, and IT ventures, while the manufacturing

investments span electrical products, steel, wood, and textiles.

These investments have generated 8,707 jobs, comprising 770 permanent and 490

temporary positions created by newly licensed entities.

The AAIC has also initiated field monitoring visits to ensure operational readiness. “Our

team works closely with new investors to address challenges promptly, enabling faster

project rollout,” Meseret added.

CHALLENGES AND REFORMS

Investors continue to face hurdles such as foreign currency shortages and workspace

availability. However, the commission highlighted progress due to macroeconomic reforms,

particularly improving foreign currency access.

“We are actively collaborating with the Mayor’s office to address workspace issues

through professional support in rental solutions and operational guidance,” Meseret

explained.

Recent reforms in the National Bank of Ethiopia’s foreign exchange policy have also

been pivotal. In October, the central bank announced a 30% increase in forex allocation to priority sectors, a move welcomed by stakeholders.

EXPANSION PLANS AND PROJECTIONS

The AAIC aims to capitalise on the momentum, targeting Birr 15 billion ($274 million) in

investments by the end of the fiscal year. A new digital investment portal, launched in November, promises to reduce registration times by 40% and improve transparency.

“We are confident these initiatives will not only attract more investors but also deepen

the trust of existing ones,” Meseret concluded.

INVESTOR SENTIMENT

Prominent business leader Ahmed Yusuf, who recently launched a $3 million IT hub in

Addis Ababa, praised the commission’s efforts.

“The improvements in investor services and forex allocation are encouraging. We hope

to see more streamlined processes for licensing and operations,” he remarked.

As Ethiopia seeks to position itself as a regional investment hub, sustained efforts in

addressing investor concerns and enhancing infrastructure will be critical.

Business & Money

Ethiopia Eyes December Debt Restructuring After IMF Review

: Ethiopia’s December IMF review may unlock long-awaited debt restructuring,

crucial for economic reforms and stalled projects like the Koysha Hydroelectric

Dam.

Ethiopia’s much-anticipated debt restructuring prospects could gain clarity this

December, as the country awaits the second review under its four-year International

Monetary Fund (IMF) program.

The Extended Credit Facility (ECF), launched in August 2023, remains central to

Ethiopia’s economic reform and debt relief efforts.

Progress Toward Debt Treatment

Last week, Ethiopian authorities reached a staff-level agreement with the IMF tied to the

second review. A comprehensive report on this review is set for release in December, a month many stakeholders, including the National Bank of Ethiopia (NBE), view as pivotal for

advancing debt treatment plans.

“Debt restructuring stands at the centre of our reform agenda. With the report’s release,

we expect rescheduling talks to gain momentum,” said Habtamu Workneh, Director of

External Economic Analysis & International Relations at the NBE.

He added that discussions are focusing primarily on extending maturity dates for Ethiopia’s debts.

IMF Support and Engagements with Creditors

The IMF has provided Ethiopia with USD 2.5 billion under its current fiscal program,

offering critical support to the country’s macroeconomic stabilisation efforts.

In parallel, Ethiopian authorities have engaged with Eurobond holders and the Official

Creditors Committee (OCC).

A debt restructuring proposal was submitted to Eurobond holders in July 2024, following

key discussions in December 2023 and May 2024.

Additionally, a global investor update held on October 1, 2024, highlighted the nation’s

ongoing economic challenges and progress in creditor negotiations.

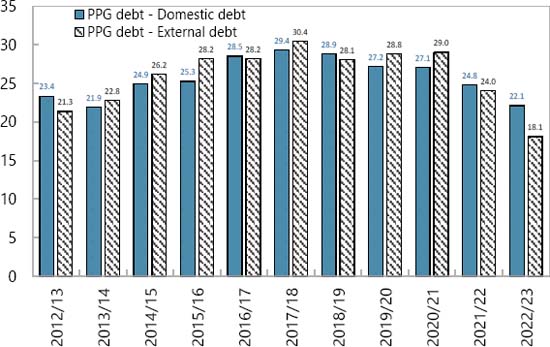

Shifting Debt Landscape

The government has reported improvements in its debt profile. Planning and Development Minister Fitsum Assefa (PhD) announced that Ethiopia had ceased relying on commercial loans and direct borrowing from the central bank.

She noted a significant drop in the external debt-to-GDP ratio to 13.7 per cent, though

the IMF’s Debt Sustainability Analysis, published in July 2024, pegged the ratio at 18

per cent as of June 2023.

External debt accounts for 45 per cent of Ethiopia’s total public and publicly guaranteed

debt, the report stated.

Financing Challenges Persist

Despite these reforms, Ethiopia’s financing challenges remain acute.

The government is seeking nearly USD 1 billion to complete the Koysha Hydroelectric

Dam project, which has stalled at two-thirds completion due to funding shortfalls.

The project is a critical component of Ethiopia’s development strategy, but its delays

underscore the broader fiscal pressures the country faces.

Expert Views on Economic Outlook

While Ethiopian officials are optimistic about the December review as a turning point,

analysts caution that real progress hinges on creditor consensus and the government’s

ability to implement reforms.

Critics have also raised concerns about inflated GDP growth figures, which they argue

may distort Ethiopia’s true debt sustainability.

Looking Ahead

The IMF review, coupled with Ethiopia’s active engagement with creditors, could mark a

a significant step forward in its quest for debt relief.

December will likely be a defining month for the country’s economic future, with broader

implications for its ability to attract investment and complete critical infrastructure

projects.

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

-

Business & Money9 months ago

Business & Money9 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics3 months ago

Politics3 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics2 months ago

Politics2 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics5 months ago

Politics5 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics5 months ago

Politics5 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics5 months ago

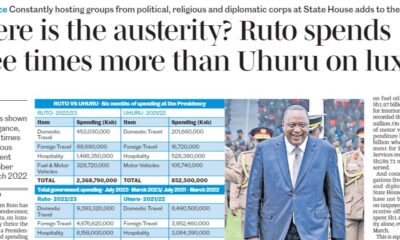

Politics5 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics4 months ago

Politics4 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money1 month ago

Business & Money1 month agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?