CLIMATE CAPITAL

Governments Spend Billions Subsidizing Climate-Harming Industries: New Report

The report further found that governments in the North continue to fuel the climate crisis disproportionately, and even though the developed world has just a quarter of the world’s population, their annual average fossil fuel subsidies amounted to USD 239.7 billion.

:Report exposes corporate capture draining $700B in public subsidies from Global South, hindering climate action while fossil fuels outpace renewable energy funding.

By Maina Waruru

A report examining corporate capture of public finance is accusing industries fueling the climate crisis, including fossil fuel ones, of draining public funds in the Global South, singling them out for squeezing out of governments USD 700 billion in public subsidies each year.

The report, How theFinance Flows: Corporate capture of public finance fuelling the climate crisis in the Global South, released on 17 September says that the climate-destructive sectors are benefiting from money that could go to paying for schooling for all Sub-Saharan African children 3.5 times over, even as Global South renewable energy projects remain starved of cash, receiving 40 times less public finance than the fossil fuels sector.

While urging governments in the developing world to allocate more of their limited resources in ways that “truly serve their people’s needs” through climate solutions for food and energy, the analysis of financial flows by ActionAid reveals that the fossil fuel sector in the region received a staggering annual average of USD 438.6 billion a year in subsidies, between 2016 (when the Paris Agreement was signed) and 2023.

The industrial agriculture sector alone benefited from government subsidies equivalent to a whopping USD 238 billion a year on average between 2016 and 2021, even as it continued to contribute to the worsening of nature, it reveals.

It further reveals that the industries causing the climate crisis are also draining the lion’s share of public funds, including in “climate-hit countries,” in places like Sub-Saharan Africa, even as initiatives providing climate solutions remain severely underfunded.

The report points to corporate capture of public finance, combined with a lack of international climate finance, as some of the factors holding back climate action in some of the “countries and communities that need it most”.

While also finding that climate finance grants from the Global North for climate-hit countries are still grossly insufficient to support climate action and the necessary transitions in the southern hemisphere, it gives examples of several countries in Africa where policies in place were in conflict with actual reality actions.

These include the fossil fuel-rich African countries of South Africa and Nigeria, which have been found to be heavily subsidizing the discredited sector.

The countries, including Bangladesh in South Asia, Action Aid says were providing fuel subsidies up to between 22 and 33 times the “per capita level of annual public investment in renewable energy” flow, for example.

As a result, in the hemisphere, renewable energy initiatives are receiving 40 times less public finance than the fossils sector, while climate finance grants amount to just a 20th of the Global South’s public finance going to fossils and industrial agriculture.

“While trillions of dollars in climate finance from the Global North to the Global South are necessary to adequately address the climate and development crises, Global South governments must allocate their limited resources in ways that truly serve their people’s needs through climate solutions for food and energy,” it says.

“Meanwhile, the failure of Global North countries to provide adequate climate finance for climate transitions means that Global South countries are locked into harmful development pathways that destroy ecosystems, grab lands and compound the injustice of climate change,” it adds.

Citing the example of Southern Africa’s Zambia, it says that the industrial agriculture sector in the country gobbled up 80 percent of the national agriculture budget in 2023, through subsidies for “climate-harming synthetic fertilizers and commercial seeds.”

“Meanwhile, only 6 percent of the Agriculture Ministry’s Agricultural Development and Productivity Programme was spent on supporting farmers to adopt agroecological, nature-friendly farming approaches, that naturally strengthen soil fertility and reduce dependency on agrochemical inputs,” it explains the contradiction.

Zambia’s neighbor Zimbabwe has made public policy statements in support of a shift towards agroecology, a shift evidenced by 34 percent of the country’s agriculture budget this year supporting farmers to adopt practices to move from climate-destructive agrochemicals.

Despite that, Zimbabwe is still using approximately 50 percent of its entire national agriculture budget towards subsidizing industrial agribusiness inputs such as fertilizers and hybrid seeds,” signaling the industry’s continued control over the sector and budget, as well as the potential to free up more public finances for public good’.

Two west African countries, the Gambia and Senegal, and South America’s Brazil were equally found to be engaging in contradictory practices, making public investments in renewable energy, on a scale that is almost comparable to the per capita public subsidy provision for fossil fuels.

In the Gambia, the scale of public investment in renewable energy is more than four-fifths that of public finance provided to fossil fuels; while in Brazil and Senegal, the scale of renewables investment was found to be two-thirds that of fossil fuel subsidies.

“Kenya’s ambition to be a global leader in renewable energy is borne out by the finding that per capita investment in renewables in the country is outspending public subsidy provision to fossil fuels. However, recent protests in Kenya against the government’s reduction of fossil fuel subsidies underline the importance of feminist Just Transition principles,” the investigation found.

“Shifts in public financing must be carefully sequenced to protect the rights of people—especially women—living in poverty. Any reductions in fossil fuel subsidies should target the wealthy corporations first. Only once accessible and democratic alternatives and comprehensive social protections are available to people on low incomes, should progressive policies be shifted,” the analysis concluded.

The report further found that governments in the North continue to disproportionately fuel the climate crisis, and even though the developed world has just a quarter of the world’s population, their annual average fossil fuel subsidies amounted to USD 239.7 billion.

Action Aid laments that renewable energy public investment in the Global South comes to an annual average of USD 10.3 billion each year, noting that even worse, renewable energy investment in the South has been on a downward trend, more than halving from USD 15 billion in 2016 to USD 7 billion in 2021.

It calls on governments to speed up the transition to green, resilient, democratic and people-led climate solutions for food and energy, such as renewable energy and agroecology. “For Global South countries already experiencing the devastating consequences of climate change, the need for global transition is all the more urgent”.

According to Arthur Larok, Secretary General of ActionAid International, the report further helps expose wealthy corporations’ ‘parasitic’ behavior.

“They are draining the life out of the Global South by siphoning public funds and fueling the climate crisis. Sadly, the promises of climate finance by the Global North are as hollow as the empty rhetoric they have been uttering for decades. It is time for this circus to end; we need genuine commitments to ending the climate crisis,” he said.

The report also debunks the “false narrative” that fossil fuel and industrial agriculture expansion in the Global South is necessary to address food insecurity and energy poverty and to provide livelihoods and public revenue, said Teresa Anderson, Global Lead on Climate Justice at ActionAid International and one of the report’s authors.

“It seems that money is the root of all climate upheaval. Climate-destructive industries are bleeding the Global South of the public funds they should be using to deal with the climate crisis. “The lack of public and climate finance for solutions means that in climate-vulnerable countries, renewable energy is receiving 40 times less public finance than the fossil fuel sector,” she added.

The time had come for the poor to stand up to industries that are draining their finances and wrecking the climate.

Public resources, the report recommends, should be directed toward supporting just transition away from climate-destructive fossil fuels and industrial agriculture and in favor of “people-led climate solutions that safeguard people’s rights to food, energy and livelihoods.”

It should also go to scaling up decentralized renewable energy systems to provide energy access, and gender-responsive agricultural extension services that offer training in agro-ecology and adaptation.

It appeals to wealthy countries to provide “trillions of dollars in grant-based climate finance each year to Global South countries on the front lines of the climate crisis,” including by agreeing to an ambitious new climate finance goal at COP29.

Further, it calls for regulation of the banking and finance sectors to end destructive financing, including setting minimum standards for human rights, social and environmental frameworks, and transformation of the international financial institutions that are pushing climate-vulnerable countries into “spiraling debt.”

Keywords:Corporate Capture:Fossil Fuel Subsidies:Climate Finance:Global South:Renewable Energy

IPS UN Bureau Report

Celebrities & Sports

Bien Aime Baraza: Kenya’s Top Spotify Artist of 2024

Bien’s music blends heartfelt lyrics with vibrant African rhythms, creating a powerful emotional connection with listeners. His hit single Inauma deeply resonated with fans, addressing themes of heartbreak and resilience, while showcasing his ability to craft compelling, introspective narratives. This track, like much of his work, blends raw emotion with the energy of African musical traditions, making it a standout in his catalog.

: Bien Aime Baraza, top Spotify artist in Kenya 2024, stands out with his soulful R&B sound and solo career success. Discover his journey and music evolution.

Bien-Aimé Baraza, widely known as Bien, has redefined the Kenyan music landscape with his soulful sound and captivating storytelling.

Crowned Spotify’s top artist in Kenya for 2024, his music spans genres, blending Afropop, R&B, and Afro-soul, making him a standout both locally and internationally.

EARLY CAREER AND RISE TO STARDOM

Bien’s music journey began at Upper Hill High School, where he formed Sauti Sol in 2006 with Savara Mudigi, Polycarp Otieno, and Willis Chimano.

The group initially sang a cappella before evolving into a multi-award-winning band. Reflecting on those formative years, Bien said, “We started as a bunch of boys who just loved to sing. We had no idea it would grow into this phenomenon”.

His passion for music was further nurtured during his studies at the United States International University, where he pursued Journalism and Media Studies.

His storytelling abilities became central to his lyrical style, characterised by emotive narratives and catchy melodies.

BREAKING AWAY FROM SAUTI SOL

In 2021, Bien began exploring solo projects while remaining part of Sauti Sol. In 2023, the band announced a “temporary separation,” explaining that they wanted to pursue individual growth.

Bien remarked, “This isn’t the end of Sauti Sol; it’s an opportunity to rediscover ourselves and bring something fresh to the table.” This independence allowed Bien to delve deeper into personal projects, which included collaborations like Bald Men Love Better with Aaron Rimbui.

MUSICAL STYLE AND LATEST PROJECTS

Bien’s music combines a mix of poignant lyrics and vibrant African rhythms. His hit single Inauma resonated deeply with fans, tackling heartbreak and resilience.

In 2024, his COLORSxSTUDIOS performance of True Love further showcased his ability to bring raw emotion and soul to his music. Speaking about his craft, he said, “Music is therapy for me; it’s how I make sense of the world and connect with my fans”

WHAT SETS BEIN APART

What makes Bien unique is his authenticity and ability to address universal themes while rooted in African culture. Unlike many local artists, Bien often experiments with sound and visuals, as seen in his COLORSxSTUDIOS performance.

His willingness to collaborate with international platforms and artists highlights his global vision for Kenyan music.

LEGACY AND IMPACT

Bien continues to inspire, proving that Kenyan artists can excel on the world stage. As Monica Kemoli-Savanne from Spotify noted, “Bien’s success is a testament to the power of African talent and storytelling”.

Whether with Sauti Sol or as a solo artist, Bien remains a force in music, bridging cultures and redefining the African sound for global audiences

Startups & Funding

Top 10 Richest East Africans Under 30: Industries & Net Worth

: Discover the top 10 wealthiest East Africans under 30, their industries,

achievements, and estimated net worths. Learn about their remarkable journeys

to success.”

Kenneth M. Njeru (25, Kenya)

- Engagement: Founder of Africa Afya Healthcare, focusing on healthcare investment services and IT solutions for healthcare access improvement.

- Industry: Healthtech and healthcare investment.

- Net Worth: Not publicly disclosed but prominent in healthcare financing in Kenya

Ayushi Chandaria (26, Kenya)

- Engagement: Founder of Design Thinking Program, fostering innovation in education.

- Industry: Education and innovation.

- Net Worth: Not publicly disclosed but recognized for her impactful work in Kenya

Alex Mativo (29, Kenya)

- Engagement: Co-founder of E-LAB, Nanasi, and Duck, leveraging technology in multiple sectors.

- Industry: Technology and entrepreneurship.

- Net Worth: Estimated at several million USD due to diversified ventures

- .

Prisca Wegesa Magori (29, Tanzania)

- Engagement: CEO and Co-founder of TenTen Explore and Smart EFD, providing innovative software solutions.

- Industry: Technology and software development.

- Net Worth: Undisclosed but influential in Tanzania’s tech scene

Andrew Ddembe (28, Uganda)

- Engagement: Co-founder and CEO of MobiKlinic, providing mobile-based healthcare solutions.

- Industry: Healthtech.

- Net Worth: Not disclosed but a key figure in Uganda’s health innovation

Arooj Sheikh (28, Kenya)

- Engagement: Founder and CEO of Beyond Kenyan Bars, working on social justice initiatives.

- Industry: Social entrepreneurship.

- Net Worth: Undisclosed, focusing on impactful social change

- .

Hildah Magaia (29, Tanzania/South Africa)

- Engagement: Professional footballer for Mazatlán FC and Tanzania’s national team.

- Industry: Sports.

- Net Worth: Significant from sports and endorsements

Chad Jones (28, Kenya/South Africa)

- Engagement: Social media influencer and brand ambassador.

- Industry: Digital media and marketing.

- Net Worth: Not disclosed but has significant brand partnerships

These individuals have demonstrated remarkable entrepreneurship and talent across East Africa, contributing to industries like health, technology, education, sports, and tourism.

CLIMATE CAPITAL

Access Bank Secures CAK Approval for National Bank Acquisition

: Access Bank to acquire National Bank of Kenya for $100M, boosting market

share to 1.9% with CAK approval and workforce retention conditions.

CAK Approves Access Bank’s Acquisition of NBK with Conditions

The Competition Authority of Kenya (CAK) approved Access Bank’s acquisition of the

National Bank of Kenya (NBK) from KCB Group, requiring Access Bank to retain 80% of

NBK’s workforce for at least one year.

The Central Bank of Kenya (CBK) must now give its final approval for the deal.

Employment Retention Key to Approval

According to CAK, Access Bank must maintain 80% of NBK’s 1,384 employees and all

316 staff from its local subsidiary, Access Bank Kenya, for a year following the

transaction’s completion. “The transaction has been approved on condition that Access

Bank Plc retains, for one year, at least 80% of the target’s current workforce,” CAK

stated.

Deal Valuation and Finalization Timeline

While the deal’s value has not been disclosed, KCB Group announced in March 2024

that NBK would be sold for 1.25 times its book value. With NBK’s 2023 book value at

$79.77 million, the acquisition is estimated to be worth approximately $100 million. The

transaction is expected to conclude in November.

Expanding Access Bank’s Kenyan Presence

Access Bank’s current footprint in Kenya includes 23 branches in 12 counties. Acquiring

NBK’s 77 branches across 28 counties will significantly boost its presence and service

offerings, including retail, corporate, and Islamic banking. Access Bank, currently

ranked as a tier 3 lender, will integrate with NBK, a tier 2 institution, enhancing its status

in the market.

Market Share and Competition Analysis

The acquisition will give the merged entity a 1.9% market share in Kenya’s banking

sector. “The combined market size is unlikely to raise competition concerns since it is

low,” CAK noted. “The merged entity will face competition from other banks in the

market. Based on this, the transaction is unlikely to substantially lessen or prevent

competition.”

-

Politics5 months ago

Politics5 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Business & Money10 months ago

Business & Money10 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics4 months ago

Politics4 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics7 months ago

Politics7 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics7 months ago

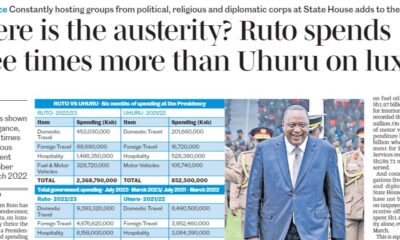

Politics7 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics6 months ago

Politics6 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money2 months ago

Business & Money2 months agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?

-

Politics7 months ago

Politics7 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout