She Business

Wandia Gichuru: Empowering Entrepreneurs Through Vivo Fashion Group

“It’s not just about the money; it’s about the impact you make. When I started Vivo, I didn’t want to just sell clothes, I wanted to create something meaningful. Fashion for me is a platform to create jobs, develop local talent, and build a sustainable industry. If a sense of purpose does not drive you, it’s tough to keep going when things get tough,”says Wandia Gichuru

:Revolutionizing Kenyan Fashion and Empowering Entrepreneurs through Innovation and Resilience

By Charles Wachira

Wandia Gichuru, Co-Founder and CEO of Vivo Fashion Group, has become a trailblazer in East Africa’s fashion scene. From its modest beginnings as an online business launched in 2011, Vivo has blossomed into one of the region’s fastest-growing fashion companies, with 30 stores across Kenya, Rwanda, Uganda, and even an international footprint with the opening of its U.S. store at Atlanta’s Atlantic Station Mall in May 2024.

The foundation of Vivo Fashion Group was driven by Gichuru’s sharp awareness of the gap in Kenya’s market for stylish, comfortable, and affordable women’s clothing that catered to local body types and tastes.

“We had no idea going in that we were solving a problem,” she says, reflecting on Vivo’s early days. “Most clothing sold in Kenya isn’t made for Kenyan women. A lot of it is secondhand or designed for Western body types, so women would have to buy clothes and modify them. We realized we needed to make clothes specifically for our market.”

Initially, customers came to her house to try on clothes. As demand soared, she and her co-founder signed their first retail lease in a Nairobi mall, a move that catapulted the business into mainstream success.

Today, Vivo’s success includes three distinctive brands—Vivo Woman, Safari, and Zoya—and Shop Zetu, an e-commerce platform launched in 2020 that has become a haven for local and international fashion and beauty brands, hosting over 300 names.

Challenges and Resilience in the Face of Adversity

Despite Vivo’s expansion and Gichuru’s success as a business leader, the journey was not without its hurdles. The COVID-19 pandemic brought one of the biggest challenges Gichuru had ever encountered. With revenues dropping by 80%, the survival of her business and the livelihoods of her 200 employees were at stake.

“Kenya doesn’t have a welfare system or the kind of government support that businesses get in other countries,” she explains. “We had to find a way to keep our people paid. That’s when we pivoted to making masks.”

Vivo’s production line shifted almost overnight to produce over a million masks, primarily bulk orders for companies. “We weren’t making much money, but we had revenue, and it saved us. That period reminded me that in business, you have to be prepared to adapt to whatever comes your way,” she shares.

Qualities Needed for Success

Gichuru’s experience has taught her invaluable lessons on what it takes to thrive as an entrepreneur.

“Resilience is key,” she asserts. “If you’re going to succeed, you must be prepared to fail and keep moving forward. There were so many times in the early years where things weren’t working, but you have to stay flexible and open to new ideas.”

She also emphasizes the importance of passion and purpose.

“It’s not just about the money; it’s about the impact you make. When I started Vivo, I didn’t want to just sell clothes, I wanted to create something meaningful. Fashion for me is a platform to create jobs, develop local talent, and build an industry that’s sustainable. If you’re not driven by a sense of purpose, it’s very hard to keep going when things get tough.”

Inspiring Future Entrepreneurs

Mentoring and supporting other women entrepreneurs has become a significant part of Gichuru’s mission. As a former judge on the Kenyan version of Shark Tank, she often found herself encouraging women to step into the spotlight.

“In our culture, women can sometimes be hesitant to show their success because they don’t want to overshadow their husbands or families. I felt it was important for a woman to be represented on that show, to inspire others to take a leap into entrepreneurship,” she says.

Through her work with Shop Zetu and Vivo, Gichuru continues to empower women by offering a platform for African brands to flourish.

“What excites me now is being able to help other entrepreneurs grow their businesses. We’re still struggling with many barriers in Africa, but unless people see someone trying and succeeding, it’s hard to imagine what’s possible,” she notes.

Role Models and Influences

Wandia’s entrepreneurial spirit is deeply rooted in her upbringing. Born in Canada to Kenyan parents, her father’s work as a civil servant influenced her view on economic development.

“My dad was a big influence. He was always thinking about how to improve the systems in our country, and that stuck with me,” she recalls.

However, when it comes to role models in her business journey, she looks up to Oprah Winfrey.

“Oprah has built a global brand that’s focused on empowering others. Her resilience and ability to maintain her values while building something so impactful has always inspired me.”

Looking Forward

Gichuru remains passionate about reshaping the way the world views Africa.

“There is so much talent and creativity here, and yet we’re often overlooked.

I’m driven by a desire to build African brands that can compete globally. Vivo’s expansion into the U.S. is just the beginning,” she says with determination.

Beyond Vivo, Gichuru sees her role as a changemaker in developing opportunities and transforming lives through fashion.

“I’m proud to show that local fashion is viable and that it can be an engine for economic development. I hope to continue creating spaces for young people to build their dreams, especially in a country where unemployment is so high.”

With her eyes set on more growth, both locally and internationally, Wandia Gichuru is a testament to the power of purpose-driven entrepreneurship. Her story is not only one of personal success but also a blueprint for uplifting others through innovation, persistence, and community empowerment.

Keywords:Wandia Gichuru: Kenyan fashion: Vivo Fashion Group: Women entrepreneurs: African fashion industry

She Business

Bethlehem Tilahun Alemu: From Ethiopian Artisan to Global Icon

: Discover how Bethlehem Tilahun Alemu built SoleRebels into a global,

sustainable footwear brand, overcoming challenges and transforming Ethiopian

craftsmanship.

Bethlehem Tilahun Alemu’s story begins in Zenabwork, a modest village on the outskirts

of Addis Ababa, Ethiopia. Growing up, she watched her community struggle with unemployment and poverty, despite a rich heritage of artisanal skills that remained largely untapped.

Fueled by determination and a desire to transform her surroundings, Bethlehem

embarked on a journey that would redefine African entrepreneurship and put Ethiopia

on the global map.

Her creation, SoleRebels, isn’t just a footwear brand. It’s a movement—an embodiment

of sustainability, culture, and empowerment.

A DREAM WOVEN WITH TRADITION

In 2005, Bethlehem founded SoleRebels with a simple yet powerful idea: to turn

Ethiopia’s rich artisanal craftsmanship into eco-friendly, globally competitive footwear.

Inspired by traditional “selate” shoes—made from recycled tyres—she envisioned a

brand that blended cultural authenticity with modern design.

She recruited local artisans, many of whom were unemployed, and encouraged them to

innovate while preserving traditional techniques.

Every pair of shoes was a masterpiece, crafted from hand-spun cotton, organic

materials, and repurposed car tyres. Bethlehem’s concept was groundbreaking: a product that told a story while making a global impact.

STARTING FROM SCRATCH

Like many entrepreneurs, Bethlehem’s initial challenge was capital.

With no access to bank loans or large investors, she relied on personal savings and

modest contributions from her family.

Slowly but surely, she built her business, reinvesting profits into training workers and

improving production tools. International grants and initiatives like the SEED Initiative later recognized the potential of her venture, providing additional support.

The early days weren’t easy. Artisans lacked modern tools, and accessing raw

materials was an uphill battle. But Bethlehem, known for her tenacity, tackled these challenges head-on. She developed partnerships with local suppliers to ensure a consistent supply of quality materials and invested in upskilling her workforce.

Breaking into the global market presented another hurdle. Competing against established brands seemed daunting, but Bethlehem found her edge: sustainability and ethical production.

In an era when consumers were becoming eco-conscious, SoleRebels’ ethos of fair wages, recycled materials, and cultural storytelling resonated deeply.

BUILDING A GLOBAL EMPIRE

Fast forward to today, and SoleRebels has a presence in over 30 countries, with

flagship stores in cities like San Francisco, Tokyo, and Barcelona.

It is also the first African footwear brand to be certified by the World Fair Trade

Organization (WFTO)—a testament to Bethlehem’s commitment to doing business the

right way.

Her company directly and indirectly employs over 1,200 people, making it one of

Ethiopia’s largest employers in the artisan sector.

Workers earn more than three times the industry average, a policy Bethlehem takes

immense pride in. “When we pay people well, we don’t just change lives—we transform

communities,” she says.

MENTORS AND INSPIRATIONS

Bethlehem often credits her late grandfather, a farmer and community leader, as her

greatest mentor.

His work ethic and deep belief in the power of local communities shaped her vision. She

also draws inspiration from global leaders, including Ethiopian Prime Minister Abiy

Ahmed, whose focus on innovation and economic growth aligns with her goals.

RISING ABOVE CHALLENGES

Bethlehem’s entrepreneurial journey has been marked by resilience. When production

scaled up, she faced supply chain disruptions that threatened deadlines. Her solution?

Cultivate long-term relationships with reliable local suppliers and diversify material

sources.

Entering new markets came with its own set of obstacles. Competing against

established brands requires a unique value proposition.

SoleRebels offered more than shoes—it offered a story: a product steeped in Ethiopian

culture, made sustainably, and crafted ethically.

VISION FOR THE FUTURE

Bethlehem isn’t slowing down. Her plans include:

- ● Expanding SoleRebels’ retail presence in Europe and Asia.

- ● Introducing sustainable clothing lines.

- ● Partnering with global brands to promote eco-friendly production in Africa.

Beyond SoleRebels, Bethlehem has a broader mission: to inspire a new narrative for

African entrepreneurship. She wants to show the world that Africa isn’t just a consumer

market but a hub for innovation and excellence.

CONCLUSION: WALKING THE TALK

Bethlehem Tilahun Alemu has redefined what it means to be an entrepreneur. From

Zenabwork’s dirt roads to the global stage, she has shown that success doesn’t come

from resources alone—it comes from vision, grit, and a deep connection to one’s roots.

With SoleRebels, Bethlehem has not only created a thriving business but a model for

how sustainable, ethical enterprises can transform communities. As she continues to

dream big, her footsteps pave the way for the next generation of African changemakers.

She Business

Joyce Akinyi Convicted: Heroin Smuggling Case Exposed

: Kenyan businesswoman Joyce Akinyi faces life imprisonment after being found

guilty of smuggling heroin worth US$ 34,483. Her history with crime has now

unravelled.

Joyce Teresia Akinyi’s story is one of dramatic highs and lows—rising from a successful

businesswoman to being convicted of a large-scale heroin smuggling operation.

With ties to international criminal networks, high-profile relationships, and repeated run-

ins with the law, Akinyi’s life has been marked by controversy and legal battles.

THE HIGH LIFE: BUSINESS AND INFLUENCE

Akinyi first gained prominence as the upscale Deep West Resort owner in Lang’ata,

Nairobi. Known for her affluent lifestyle, she mingled with Kenya’s elite and maintained

significant business interests.

However, behind the glamorous facade lay a darker world of alleged criminal activity.

Her personal life was equally turbulent. In 1998, she met Nigerian businessman Anthony Chinedu, and the couple had two children before formalising their union.

Their relationship was rocky, marked by numerous arrests on drug trafficking charges.

In 2013, Chinedu was deported from Kenya after authorities seized drugs in his

possession, a move that further exposed Akinyi to public scrutiny.

A HISTORY OF LEGAL TROUBLES

Over the years, Akinyi faced repeated allegations of drug trafficking. Her name became

prominent in 2008 when she was arrested in New Delhi, India, alongside former

Budalang’i MP Raphael Wanjala.

Authorities detained the pair with undeclared cash worth Sh7.59 million, suspected to

be linked to drug deals. Although released after intervention by the Kenyan government, the incident marked the start of a string of legal troubles for Akinyi.

In 2013, she and Wanjala were arrested again on the Nairobi-Namanga highway with a

suspicious white powder. Although they claimed it was corn flour, suspicions persisted,

and Akinyi’s criminal associations deepened.

THE TURNING POINT: CONVICTION FOR HERION SMUGGLING

Akinyi’s criminal activities reached a dramatic conclusion in 2019 when a police raid on

Deep West Resort uncovered 2kg of heroin worth Sh5 million hidden in a shoe rack.

The Anti-Narcotics Directorate linked the operation to an international smuggling

network coordinated by Akinyi.

The Jomo Kenyatta International Airport Tribunal found Akinyi guilty under Article

4(a) of the Narcotic Drugs and Psychotropic Substances Control Act, which

mandates life imprisonment for drug trafficking.

The court heard compelling evidence, including photographs of heroin wrapped in white

tape, voice recordings coordinating smuggling activities, and the discovery of a Tabita

Digital Scale used to weigh drugs.

Akinyi’s co-defendants, Paulin Kalala Musankinshay and Peres Adhiambo, were

similarly implicated. Evidence also revealed that Akinyi used multiple fake passports, including a Congolese passport in the names of “Mape Marline Kambura” and “Raha Eveline

Kambere,” enabling her to operate under different aliases.

FINANCIAL CRIMES AND ASSET RECOVERY

Beyond drug trafficking, Akinyi’s wealth came under scrutiny. In 2021, she lost two

luxury vehicles worth Sh20 million to the State, deemed proceeds of crime.

Investigations by the Asset Recovery Agency revealed that Akinyi deposited

suspiciously large sums ranging from Sh60,000 to Sh20 million into various bank

accounts. Her real estate investments—villas built and rented out—further indicated

illicit income sources.

THE END OF THE ROAD

On December 10, 2024, Akinyi faces sentencing, which could include life

imprisonment and a Sh5 million fine. Her fall from grace highlights the dangers of

unchecked ambition and illegal pursuits. Magistrate Njeri Thuku, who presided over the

case, dismissed Akinyi’s defence that the drugs were planted by her estranged husband

Chinedu, calling it baseless.

CONCLUSION

From her meteoric rise as a business mogul to her conviction as a drug trafficker, Joyce

Akinyi’s life is a cautionary tale of how power, wealth, and crime can intertwine.

Her story also underscores Kenya’s ongoing battle with drug trafficking and the far-reaching

consequences of organised crime. For Akinyi, the glitz and glamour of her former life

have now given way to the stark reality of justice.

Nb: Exchange rate 1 USD = 145 Ksh

She Business

How Margaret Nyamumbo Built Kahawa 1893 from the Ground Up

: Discover Margaret Nyamumbo’s journey from Kenya to the U.S. and how she

built Kahawa 1893 to empower women coffee farmers, achieving business

success and social impact

Early Life and Education: Pursuing Global Opportunities

Margaret Nyamumbo’s entrepreneurial journey began in Kenya, where she grew up on a coffee

farm. However, she moved to the U.S., a decision that significantly shaped her path.

In 2000, she travelled to Smith College, a prestigious liberal arts institution in Massachusetts,

to study economics.

Her desire to study abroad stemmed from the limited educational opportunities available for

women in Kenya at the time. As she later explained, her family encouraged her decision, viewing it as a way to give her the best opportunities for success.

After earning her degree from Smith College, Nyamumbo pursued an MBA at the Wharton

School of the University of Pennsylvania, known for its rigorous business programs.

This solidified her foundation for a future in business, although it was the allure of her roots and a passion for coffee that eventually led her back to entrepreneurship.

From Corporate Work to Entrepreneurship: Embracing Coffee Culture

After completing her studies, Nyamumbo worked in investment banking and consulting, but the world of corporate finance didn’t fully satisfy her ambitions.

It was her return to the coffee industry, deeply connected to her Kenyan heritage, that drove

her entrepreneurial leap. With a vision to support East African coffee farmers, particularly women, Nyamumbo founded Kahawa 1893 in 2018, a coffee brand dedicated to highlighting Kenya’s coffee culture while mpowering local farmers.

The name “Kahawa” is the Swahili word for coffee, while “1893” marks the year when coffee

was first commercially grown in Kenya, grounding her brand in historical significance.

Through Kahawa 1893, Nyamumbo aimed to bring a new approach to the coffee business, one

that not only celebrated East African coffee but also created fair wages for farmers.

Building a Brand with Purpose: Empowering Farmers

Nyamumbo’s vision for Kahawa 1893 went beyond just selling coffee.

She wanted to create a direct impact on the lives of the farmers growing the coffee beans.

The brand’s model incorporated a system where customers could tip the farmers directly via a

QR code found on the coffee bags.

This innovation set the company apart from competitors and positioned it as a socially

responsible business that directly benefited those involved in the production process.

In 2021, Kahawa 1893 hit a major milestone, getting its coffee stocked in Trader Joe’s—the

first Black- and woman-owned coffee brand to be featured there.

This breakthrough moment was significant for Nyamumbo, marking the recognition of her hard work and her commitment to uplifting local farmers.

Overcoming Challenges: What It Takes to Succeed

Despite the challenges of entering a highly competitive market, Nyamumbo’s determination

never wavered. In a 2022 interview with Forbes, she shared her thoughts on what it takes to be a successful entrepreneur.

“You have to be able to take the punches and keep moving,” she said. Her advice reflects the

reality of entrepreneurship: persistence, resilience, and a willingness to learn from failure are

crucial for success.

Nyamumbo also emphasised the importance of passion. “You’ve got to love what you do, or you won’t have the energy to push through the tough times,” she said.

These values have guided her journey, driving Kahawa 1893 to not only succeed but also to

change the way the coffee industry operates, particularly about fair trade and community

empowerment.

The Future of Kahawa 1893: Expanding Horizons

With her success on platforms like Shark Tank and continued global distribution, Nyamumbo’s

Kahawa 1893 is poised for growth.

Her brand continues to expand its reach, and the emphasis on ethical sourcing, community

impact, and high-quality coffee will likely remain at the heart of her business model as she looks to further innovate in the global coffee market.

Through Kahawa 1893, Nyamumbo has shown that business success is not just about

profits—it’s about purpose, people, and passion.

-

Politics5 months ago

Politics5 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Business & Money10 months ago

Business & Money10 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics4 months ago

Politics4 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics7 months ago

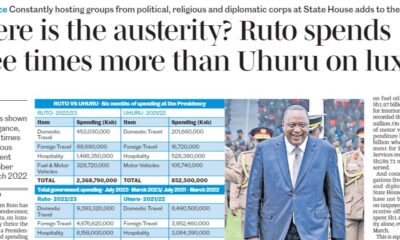

Politics7 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics7 months ago

Politics7 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics6 months ago

Politics6 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money3 months ago

Business & Money3 months agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?

-

Politics7 months ago

Politics7 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout