Business & Money

JPMorgan Chase Enters Kenya: Landmark Move for East Africa

“JPMorgan’s decision to establish a representative office in Kenya affirms the confidence that global financial institutions have in our economy. It is a strong signal that Kenya is a key player in the financial architecture of Africa, and we look forward to welcoming more international investments,”said CBK Governor Kamau Thugge.

: JPMorgan Chase has been granted a license by the Central Bank of Kenya to establish a representative office in Nairobi, marking the U.S. banking giant’s strategic expansion into East Africa. This move strengthens Kenya’s position as a financial hub and opens doors for increased foreign investment and partnerships in the region

By Charles Wachira

In a major development for Kenya’s financial sector, the Central Bank of Kenya (CBK) on October 14, 2024, granted a license to JPMorgan Chase, one of the largest banking institutions globally, with assets totaling over $4.1 trillion. The bank has been authorized to open a representative office in Nairobi, marking a significant step in its long-anticipated entry into East Africa’s biggest economy.

The establishment of the JPMorgan Chase N.A. Representative Office Kenya comes just ahead of a scheduled visit by JPMorgan CEO Jamie Dimon, who is set to tour Kenya, Nigeria, South Africa, and Côte d’Ivoire as part of the bank’s strategy to expand its footprint across the African continent.

“The Central Bank of Kenya (CBK) announces the granting of authority to JPMorgan Chase Bank N.A. of the United States to establish a representative office in Kenya by the name JPMorgan Chase N.A. Representative Office Kenya. This authority is granted pursuant to Section 43 of the Banking Act and follows the fulfillment by JPMorgan of the stipulated requirements,” CBK said in its official statement.

What a Representative Office Means for Kenya

Under Kenyan law, foreign banks’ representative offices serve as marketing and liaison branches but are not allowed to conduct direct banking transactions, such as accepting deposits or offering loans. Instead, they focus on marketing their services and signing deals on behalf of their parent banks. The JPMorgan office in Nairobi will follow this model, seeking to market its banking services while capitalizing on large-scale transactions that local banks may not be well-equipped to handle.

This move ends a decade-long wait for JPMorgan, which initially expressed interest in entering the Kenyan market back in 2012. With this development, JPMorgan becomes the second U.S. bank with a presence in Nairobi, joining CitiBank in targeting multinationals and sovereign debt deals in East Africa.

CBK noted that JPMorgan’s entry into Kenya will not only diversify the country’s financial sector but also catalyze trade and investment across the region.

“The JPMorgan Chase Bank N.A Representative Office Kenya will contribute to the diversity of Kenya’s financial sector and catalyze trade and investments. Additionally, the authorization of the representative office affirms Kenya’s standing as a premier financial services hub,” the CBK said in a statement.

A Global Giant Eyes East Africa

JPMorgan Chase, already a significant player in Africa with offices in Nigeria and South Africa, is now targeting Kenya as its East African hub. The bank’s operations on the continent largely revolve around asset management, commercial banking, and investment services, particularly for multinational corporations and sovereign debt transactions. This expansion into Kenya aligns with the bank’s strategy of tapping into emerging markets for growth.

CEO Jamie Dimon’s upcoming visit to Kenya is expected to reinforce the bank’s long-term commitment to the region. Dimon has been vocal about JPMorgan’s interest in expanding across Africa, having hired a team in 2018 to explore opportunities in Kenya and Ghana. Now, with Kenya officially on board, JPMorgan is looking to increase its involvement in major corporate and sovereign debt deals across the continent.

Why Now?

The timing of JPMorgan’s entry is particularly significant as it comes at a time when global financial institutions are increasingly eyeing Africa for investment opportunities. In 2023, Kenya selected JPMorgan, alongside CitiBank and Standard Chartered Bank, as lead arrangers for its Eurobond, underscoring the bank’s growing involvement in the region’s financial activities.

The new office in Nairobi positions JPMorgan to capture a larger share of East Africa’s growing market, with a particular focus on serving U.S. multinationals, wealth funds, and institutional investors operating in the region. Dimon’s visit is also expected to include discussions on expanding operations to other emerging financial hubs like Côte d’Ivoire, which could further cement the bank’s presence on the continent.

Economic Impact and Opportunities

JPMorgan’s entry into Kenya is a win for the country’s ambition to become the premier financial services hub in East Africa. With the bank’s arrival, Kenya stands to gain from increased foreign direct investment, job creation, and access to global financial expertise. For local businesses, particularly those dealing with large-scale investments, JPMorgan’s presence offers new opportunities for growth and partnership.

This move is also symbolic of Kenya’s growing integration into global financial markets. As the country continues to develop infrastructure and deepen financial reforms under its Vision 2030 agenda, attracting global financial giants like JPMorgan reaffirms its standing as a key player in Africa’s economic transformation.

Looking Ahead

As JPMorgan Chase begins its operations in Nairobi, Kenya is likely to see further inflows of foreign capital and interest from other global financial institutions looking to tap into the East African market. The move sets a precedent, positioning Kenya not just as a regional leader, but as a gateway to Africa for global financial services.

In the words of CBK Governor Kamau Thugge, “JPMorgan’s decision to establish a representative office in Kenya affirms the confidence that global financial institutions have in our economy. It is a strong signal that Kenya is a key player in the financial architecture of Africa, and we look forward to welcoming more international investments.”

JPMorgan’s Nairobi office will serve as a cornerstone in the bank’s African expansion strategy, reinforcing Kenya’s role as a financial hub and accelerating its economic development goals. As the country welcomes this new chapter, the future of Kenya’s financial sector looks poised for unprecedented growth.

Keywords:JPMorgan Chase Kenya:Nairobi financial hub:JPMorgan East Africa expansion:Kenya foreign investment::Global banks in Africa

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

Business & Money

Top 10 Kenyan banks by total assets as of 2023, based on data from the Central Bank of Kenya:

KCB Bank Kenya Limited

Total Assets: KSh 1.425 trillion

Market Share: 17.4%

Equity Bank Kenya Limited

Total Assets: KSh 1.004 trillion

Market Share: 12.2%

NCBA Bank Kenya PLC

Total Assets: KSh 661.7 billion

Market Share: 9.2%

Co-operative Bank of Kenya

Total Assets: KSh 624.3 billion

Market Share: 8.8%

Absa Bank Kenya PLC

Total Assets: KSh 520.3 billion

Market Share: 6.6%

Standard Chartered Bank Kenya

Total Assets: KSh 429.3 billion

Market Share: 5.9%

Stanbic Bank Kenya

Total Assets: KSh 449.6 billion

Market Share: 5.8%

I&M Bank Limited

Total Assets: KSh 405.6 billion

Market Share: 5.4%

Diamond Trust Bank Kenya

Total Assets: KSh 399.6 billion

Market Share: 5.3%

Bank of Baroda (Kenya) Limited

Total Assets: KSh 201.9 billion

Market Share: 2.8%

These rankings illustrate the dominance of large Tier 1 banks, which collectively control over

76% of the market share. Strategic expansions, increased deposit mobilisation, and robust

lending practices underpin the sector’s strong performance

Business & Money

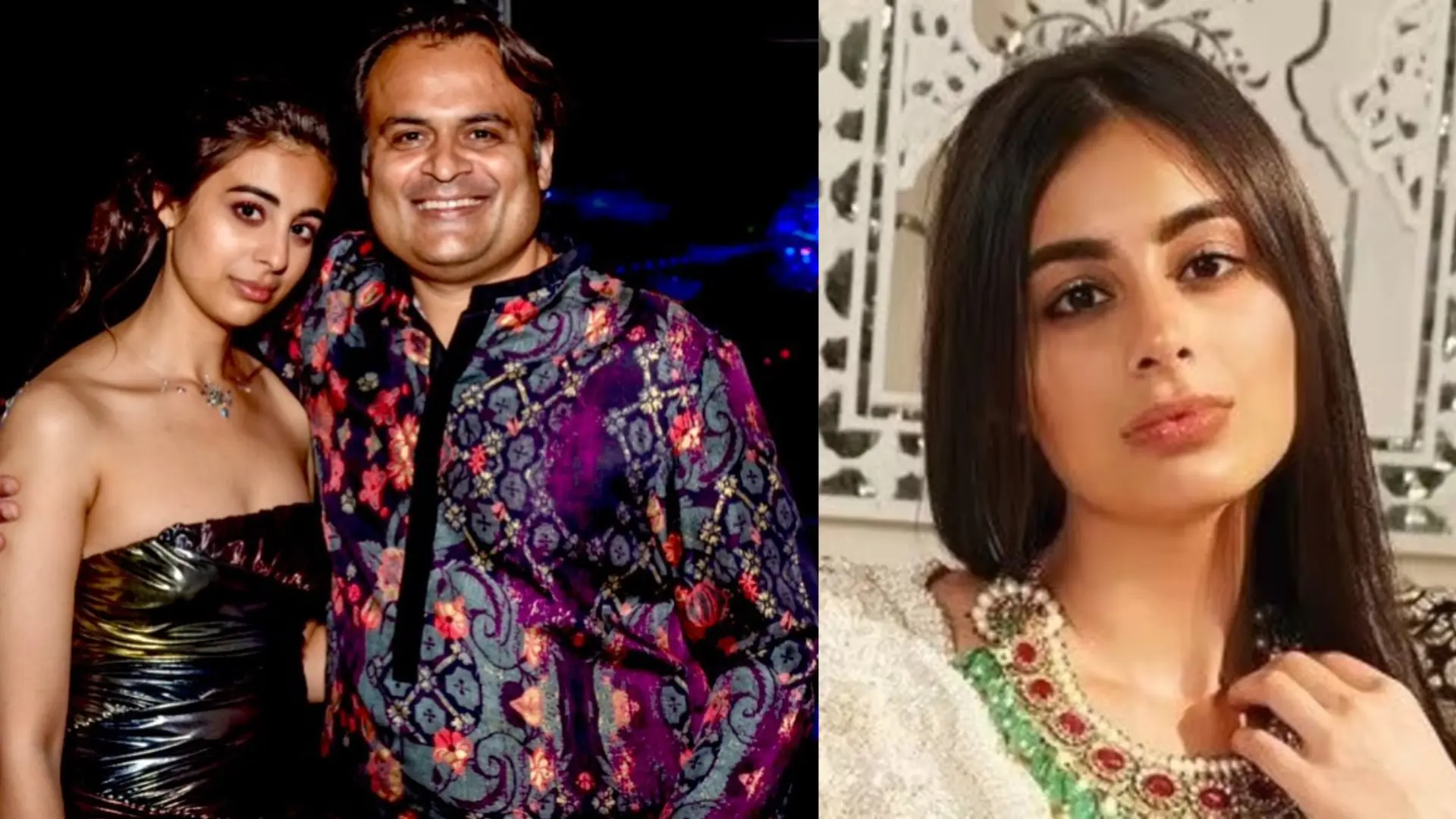

Vasundhara Oswal’s Legal Struggles and Family’s Plea for Justice

: Vasundhara Oswal, daughter of industrialist Pankaj Oswal, faces serious

charges in Uganda. The Oswals call for UN intervention amid claims of corporate

jealousy.

Vasundhara Oswal, the 26-year-old daughter of prominent Swiss-Indian industrialist

Pankaj Oswal, has found herself at the centre of a legal storm in Uganda.

Her father, a well-established business figure, is known for his diverse investments,

most notably a $150 million ethanol plant in Uganda.

This plant, the largest of its kind in East Africa, is a key part of Oswal’s broader strategy

to invest in industrial and eco-friendly solutions in the region. The facility produces extra-neutral alcohol (ENA), which is used in the beverage, cosmetics, and pharmaceutical industries.

It is recognised for its modern technology and sustainable practices, such as zero liquid

discharge, emphasising the Oswal family’s commitment to both industrial growth and

environmental responsibility.

In addition to the ethanol plant, Pankaj Oswal has made strategic investments across

various industries, including petrochemicals, agriculture, and real estate.

His ventures reflect a global reach, extending to Australia and India, where he has

been involved in industries ranging from agriculture to renewable energy.

His diversified business approach and commitment to sustainability have made him a prominent figure in international business. However, in October 2024, the family’s legacy was overshadowed by the legal troubles surrounding Vasundhara Oswal.

She was detained on October 1, 2024, after being accused of involvement in the

alleged murder of Mukesh Menaria, a former employee who had worked with the

Oswals since 2017.

Menaria had accused the family of harassment but later testified under oath that they

had not harmed him Despite this, charges of kidnapping and murder were brought against Vasundhara.

Her family has strongly denied these allegations, claiming that the charges are

politically motivated and part of a larger conspiracy orchestrated by their business rivals

in collaboration with corrupt officials in Uganda.

The Oswals have appealed to the United Nations, seeking intervention and asserting

that the legal proceedings against Vasundhara are unlawful. Vasundhara has actively managed the family business throughout her career, especially the ethanol plant, and led the company’s sustainable initiatives.

Beyond her business involvement, she has also been an advocate for community

welfare and mental health, further cementing the Oswal family’s reputation for corporate

social responsibility.

The unfolding legal drama has raised important questions about the intersection of

business, politics, and the legal systems in Uganda.

While the Oswal family’s ventures reflect a blend of industrial innovation and social

responsibility, the legal challenges Vasundhara faces have cast a shadow over their

business empire, highlighting the complex dynamics at play in East Africa.

-

Business & Money8 months ago

Business & Money8 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics3 months ago

Politics3 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics2 months ago

Politics2 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics4 months ago

Politics4 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics5 months ago

Politics5 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics5 months ago

Politics5 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics4 months ago

Politics4 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money1 week ago

Business & Money1 week agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?