Business & Money

Dr. Gideon Muriuki: Kenya’s Low-Key Banker Achieving Surprising Success

In turns out Dr. Muriuki’s inchoate tenure at Co-op Bank has indelibly become the stuff for corporate folklore. It encapsulates the blue true never-say-die spirit of a local turnaround artist with generic media drawn from around the globe routinely regurgitating his initial performance running for 12 months where he set in motion, the sensational return to profit of a hemorrhaging entity.

:Co-operative Bank’s transformation under Dr. Gideon Muriuki: From losses to record profits, leadership awards, and strategic growth in Kenya’s financial sector

By Charles Wachira

In 1989, the Cooperative Bank of Kenya, which was named as East Africa’s Regional Bank of the Year.In that year it restructured its hierarchical structure, creating a Managing Directors’ position as the last line of defense, supplanting that of a General Manager.

Dr. Erastus Muriethi, an emblematic cooperative movement influencer would become the first holder of the office, only later for him to unwittingly entrap sections of Kenya’s credulous media into scandalmongering the bank after getting the boot in 2001.

What followed next was the arrival of 39-year old Gideon Maina Muriuki as a replacement, who would 21- years later be named the Best Bank CEO in Africa .

Irrefutably at the time, the career progression of this State honouree who has so far being awarded three awards including that of First Class Chief of the Order of the Burning Spear in 2017 plus a 2011 Moran of the Order of the Burning Spear (MBS) and also that of the Order of Grand Warrior” (OGW) in 2005, arguably caught local banking pundits flat footed.

For here was a quintessential own man with zilch linkage to old money or famous last name, a bloke who shunned hobnobbing with influence peddlers drawn from Kenya’s political class – often the old and tested practice of landing a top job in Sub -Saharan Africa’s third biggest economy – instead this was a man whose candidature spoke of upending the old Kenyan networks that thrived in the world of kakistocracy -indeed he was the proverbial great destroyer of the old order, arriving mutedly to a feeble house.

His resume initially set him out for a career as a number cruncher for ideally his 1988 undergrad degree from the University of Nairobi was in mathematics.

But that was not to be.

For this Kagumo High School alumni inadvertently chose to genuflect towards the thinking of Roy T. Bennett, a highly acclaimed author who famously wrote, “ Create a vision for the life you really want and then work relentlessly towards making it a reality.”

It turns out Muriuki was laser focused on succeeding and unbeknownst to him Bobby Unser was his guardian angel for when the opportunity showed up he was prepared and success followed suit as he transited into the byzantine world of banking like a natural.

On 1st March 2001, the day he took the reins of leadership, Muruiki had cloaked 12-years working as a banker, six under the the clock of Co-op Bank, an intrepid corporate body, that this indigene of Mung’aria Village in Tetu, Nyeri County says “continues to pursue strategic initiatives that focus on resilience and growth in the various economic sectors. This is anchored on a successful universal banking model supported by an innovative digital presence, a wide physical footprint, 9 million customers and the unique synergies in the over 15 million member co-operative movement that is the largest in Africa.”

When Muriuki got into the corner office of this lender he transformed it to become a pragmatic and sensitive market leader unafraid to take bold decisions as witnessed when for example the bank shed of its befuddling tagline that previously read, “ The Bank on the Move”, replacing it with one that today simply gloats “We are you” intrinsically personalizing the bank- client relationship for together with his team at Co-op Bank they made a conscious business decision to understand the spirit behind the marketing truism that states , Taglines Don’t Position a Brand — Slogans Do .

A former Director of the Bank who only spoke on condition of anonymity reminisces on why they promoted Dr.Muriuki to the foremost position.

“ We were clear in our minds that the institution simply required moral leadership to stabilize. We were looking for somebody who could shepherd the bank by sheer force of their personality. A person who could inspire legitimate confidence in the marketplace. For at the time, turning the other way seemed the preferred modus operandi around the country. But there was this palpable feeling in the air that was indicating that Kenyans literally were fatigued with the system, real change was beckoning. And we dared to meet the moment by competitively seeking a fresh face,” says this former Director, now a septuagenarian but actively involved in the country’s cooperative movement.

Verifiably before Dr. Muriuki’s ascendancy, becoming the big kahuna, the top management of Co-op Bank had routinely displayed a proclivity of thumbing its nose to fiduciary duty, a malice that was ubiquitous across the industry, beginning disproportionately in late 1980s running to the tail end of the 90s.

A March 28 2000 declassified World Bank report apparently showed how fraudsters used the bank to fleece local coffee farmers at a time when the lender, currently the fifth biggest company by equity capital, at the Nairobi Securities Exchange, (NSE) which is the fifth biggest by market capitalisation in Africa, was cavalierly reporting a staggering Ksh 2.3 billion loss .

Coincidentally, during the period, the country’s economic health was also anemic with the peremptory regime of Daniel arap Moi facing the challenge of foreign aid deprivation for exhibiting a totalitarian streak.

Indeed the Organization For Economic Cooperation and Development (OECD) had weighed in saying the Kenyan economy had for the past four years ending 2000 registered negative 0.5 % GDP growth “ following weak macroeconomic performance and governance –related problems that continue to pitch Kenya against the major international donors, thereby depriving the country of much needed external inflows.”

With two scholars Samuel Muiruri Muriithi and Lynette Low, in an academic paper titled, The Kenya Banking Industry:Challenges and Sustainability , saying between 1980 and 2000, the country’s financial industry was characterized by major financial upheavals that had triggered collapse of many banks, while others were in and out of receivership.

Said the duo.“ The crises were attributed to non-performing loans, weak internal control mechanisms, poor governance and poor leadership,” arguably also a fair description of the status of Co-op bank at the time.

But a fresh team led by Muriuki, had within three years upended naysayers’ predictions, reporting an enhanced profit of Ksh 183 million ( present day US$ 1,503,698) ,reflecting a 78% improvement on the Ksh 103 million(US$846,343) profit reported in 2002.

The good times were arguably back.

With the prediction of a new government coming true in 2002 the mood in the country morphed to one that was palpable with optimism, emboldened by the grand slam win of Mwai Kibaki at the presidential sweepstakes, a technocrat credited with writing the Sessional Paper Number 10 of 1965 which laid down the foundation of Kenya’s Steeler economy associated with the booming 70s.

And as a positive spin-off, the banks Board of Directors agreed for payment of a dividend of 3% during the said period, bringing to a close, a dividend drought that had run for seven years.

With the exemplarily show of leadership emanating from the bank, the Co-operative movement within Kenya, disproportionately the biggest shareholders of Co-op Bank decided to double the capital base of the increasingly nimble and ambitious institution in 2004, injecting an additional capital of Ksh1.1 billion (US $ 9,038,619), bringing the total shareholders’ equity of the Bank to a whopping Ksh 2.3 billion (present day US$ 18,898,931).

Now the Bank was understandably ready to play in the big leagues.

Invariably then, the world was batting for Kenya’s renaissance after years of decay and stagnation. And there was a good reason behind the burgeoning confidence.

With Dr. Joel D. Barkan, nicely capturing the mood of the day.

“Few African countries have experienced the broad-based renewal of their economies that Kenya has enjoyed since 2005. After nearly two decades of zero to negative economic per capita growth, Kenya turned the corner in 2004 with an aggregate growth rate of 5.1 percent. This rose to 5.7 percent in 2005 and 6.1 percent in 2006 – and continues to rise.

“Kenyans have not enjoyed such prosperity since the mid-1960s and early seventies when Jomo Kenyatta governed their country,” he wrote.

In 2022, .Muriuki, marked 33 years since getting employed as a banker- of which, 27 he has resolutely being the core cheerleader of what is now a Ksh 68.94 billion ( US$ 566,474,934)capitalized behemoth as of Nov 5 2022, making it the third biggest bank within East Africa.

To close Nairobi watchers he has remained true to Albert Einsteins’ counsel that advises that one should not try to become a man of success only, but rather they should try to become a man of value.

Indeed human history is transfixed with people who excel exceedingly in their chosen fields with institutions of higher learning for example beginning in 1478 or 1479 awarding honorary doctorate degrees to exceptional achievers.

In Kenya the first honorary degree was awarded in 1970 and the rite of passage has routinely been repeated during graduation ceremonies throughout the globe where Kenyans and intermittently global outliers get the rare opportunity to grace the red ubiquitous red carpet.

For example, a sneak preview of that hallowed list from the university of Nairobi , shows a determination by institutions to recognize men and women who are bellwethers in generic fields.

This Nov 2022, Muriuki who today is reverently referred to as Dr. courtesy of this tradition, received his third honorary degree for singularly contributing immeasurably to the local banking sector.

While receiving his second honorary Doctorate of Humane Letters from the Co-operative University of Kenya in Feb 2022 the citation was apt.

“This conferment of Doctor of Humane Letters (Honoris Causa) is in recognition of his distinguished career in the banking industry, immense contribution to the co-operative sector, exemplary service to the nation, successful turnaround and great expansion of the Co-operative Bank of Kenya,” the university said

And when he received his first Honorary Degree of Doctor of Businesses Leadership (Honoris Causa) from Kabarak University it was in recognition of his exemplary performance in entrenching the co-operative banking model in the Kenyan financial market and providing demonstrable leadership and sustainable growth over the last 10 years where now Dr.Muriuki displayed his traditional self-deprecating demeanor.

Said he: “The success of Co-operative Bank cannot be appreciated by simply looking at its good financial performance alone. Rather, its strength lies in the transformative influence it has had in the lives of millions of Kenyans who depend on the co-operative movement. It is a great privilege for me to serve an institution that has made such a tremendous contribution to the improvement of the welfare of so many Kenyans. I take this award as an affirmation that service with integrity and honour will always be rewarded in the fullness of time.”

In addition, Dr. Muriuki also is a recipient of a decoration of Chevalier de L’orde National du Burkina Faso awarded by the President of Burkina Faso in recognition of his outstanding contribution to development of rural finance in Africa

In turns out Dr. Muriuki’s inchoate tenure at Co-op Bank has indelibly become the stuff for corporate folklore. It encapsulates the blue true never-say-die spirit of a local turnaround artist with generic media drawn from around the globe routinely regurgitating his initial performance running for 12 months where he set in motion, the sensational return to profit of a hemorrhaging entity.

“ Despite the difficult circumstances, the year 2001 saw considerable improvement. That year on 1 March, Dr. Gideon Muriuki became the company’s Managing Director. At the end of the fiscal year, the bank reported a 60% reduction in their 2000 losses. In the year 2002, the turnaround was official when the bank reported a profit of KES 103 million. During the following years, the bank saw amazing growth. By the end of 2007, Co-op Bank recorded a profit of Kes 2.3 billion and declared an eight per cent dividend, its highest payout by far in years, “ reported the International Banker.

He is also hailed for listing the lender at the Nairobi Stock Exchange (NSE) at a time when even the most optimistic analysts were predicting a poor subscription of the Initial Public Offer (IPO).

“ Analysts were expecting a lower success rate for the IPO, which came in the middle of a bear run at the Nairobi Stock Exchange made worse by a global economic meltdown,” the Daily Nation commented.

On December 22 2008 the Bank went public, listing at the Nairobi Securities Exchange (NSE).

In fact, the Bank’s IPO went ahead to be awarded the Best IPO in Africa in 2008.

Always leading from the front, Dr.Muriuki has steered growth of the local bank, which now has a footprint in South Sudan.

But for now the lenders five year plan beginning in 2020 is focused on expanding singularly in Kenya with an Aug 2020 move that saw Coop Bank acquiring Jamii Bora Bank, being part of that trajectory.

Meanwhile besides being the Managing Director of Co-op Bank , Dr. Muriuki is also a Director of Kingdom Securities Limited, Vice-President Africa – International Co-operative Banking Association (ICBA), former Chairman, Governing Council of the Africa

International University and former Chairman, African Rural and Agricultural Credit Association.

Ladies and gentlemen, let’s all arise and applaud a man who has proved again and again that the only limit to our realization of tomorrow will only be limited by our doubts of today.

Keywords:Co-operative Bank of Kenya restructuring:Gideon Muriuki’s leadership:Banking industry turnaround:Kenya’s financial sector growth:Co-op Bank’s IPO success

Business & Money

Ethiopia Attracts $53.5 Million in Q1 Investments, Creates 8,700 Jobs

: Ethiopia attracts $53.5M in Q1 investments, creating 8,700 jobs. Growth driven

by reforms, with a focus on service and manufacturing sectors.

The Addis Ababa Investment Commission (AAIC) announced a promising start to the

2023/24 fiscal year, with 612 investors registering a combined capital of Birr 2.93 billion

($53.5 million) in the first quarter.

This reflects a 13% growth compared to the same period last year, signalling sustained

investor confidence despite economic challenges.

Speaking at a press briefing on November 30, AAIC’s Director of Communication,

Meseret Woldemariam, credited the growth to policy reforms and enhanced investor

facilitation.

“Our efforts to streamline investment processes and resolve bottlenecks are yielding

results. We remain committed to ensuring investors thrive in Addis Ababa,” she said.

SECTORIAL CONTRIBUTIONS

The majority of the newly licensed investors are in the service and manufacturing

sectors. The service sector includes hotels, tourism, and IT ventures, while the manufacturing

investments span electrical products, steel, wood, and textiles.

These investments have generated 8,707 jobs, comprising 770 permanent and 490

temporary positions created by newly licensed entities.

The AAIC has also initiated field monitoring visits to ensure operational readiness. “Our

team works closely with new investors to address challenges promptly, enabling faster

project rollout,” Meseret added.

CHALLENGES AND REFORMS

Investors continue to face hurdles such as foreign currency shortages and workspace

availability. However, the commission highlighted progress due to macroeconomic reforms,

particularly improving foreign currency access.

“We are actively collaborating with the Mayor’s office to address workspace issues

through professional support in rental solutions and operational guidance,” Meseret

explained.

Recent reforms in the National Bank of Ethiopia’s foreign exchange policy have also

been pivotal. In October, the central bank announced a 30% increase in forex allocation to priority sectors, a move welcomed by stakeholders.

EXPANSION PLANS AND PROJECTIONS

The AAIC aims to capitalise on the momentum, targeting Birr 15 billion ($274 million) in

investments by the end of the fiscal year. A new digital investment portal, launched in November, promises to reduce registration times by 40% and improve transparency.

“We are confident these initiatives will not only attract more investors but also deepen

the trust of existing ones,” Meseret concluded.

INVESTOR SENTIMENT

Prominent business leader Ahmed Yusuf, who recently launched a $3 million IT hub in

Addis Ababa, praised the commission’s efforts.

“The improvements in investor services and forex allocation are encouraging. We hope

to see more streamlined processes for licensing and operations,” he remarked.

As Ethiopia seeks to position itself as a regional investment hub, sustained efforts in

addressing investor concerns and enhancing infrastructure will be critical.

Business & Money

Ethiopia Eyes December Debt Restructuring After IMF Review

: Ethiopia’s December IMF review may unlock long-awaited debt restructuring,

crucial for economic reforms and stalled projects like the Koysha Hydroelectric

Dam.

Ethiopia’s much-anticipated debt restructuring prospects could gain clarity this

December, as the country awaits the second review under its four-year International

Monetary Fund (IMF) program.

The Extended Credit Facility (ECF), launched in August 2023, remains central to

Ethiopia’s economic reform and debt relief efforts.

Progress Toward Debt Treatment

Last week, Ethiopian authorities reached a staff-level agreement with the IMF tied to the

second review. A comprehensive report on this review is set for release in December, a month many stakeholders, including the National Bank of Ethiopia (NBE), view as pivotal for

advancing debt treatment plans.

“Debt restructuring stands at the centre of our reform agenda. With the report’s release,

we expect rescheduling talks to gain momentum,” said Habtamu Workneh, Director of

External Economic Analysis & International Relations at the NBE.

He added that discussions are focusing primarily on extending maturity dates for Ethiopia’s debts.

IMF Support and Engagements with Creditors

The IMF has provided Ethiopia with USD 2.5 billion under its current fiscal program,

offering critical support to the country’s macroeconomic stabilisation efforts.

In parallel, Ethiopian authorities have engaged with Eurobond holders and the Official

Creditors Committee (OCC).

A debt restructuring proposal was submitted to Eurobond holders in July 2024, following

key discussions in December 2023 and May 2024.

Additionally, a global investor update held on October 1, 2024, highlighted the nation’s

ongoing economic challenges and progress in creditor negotiations.

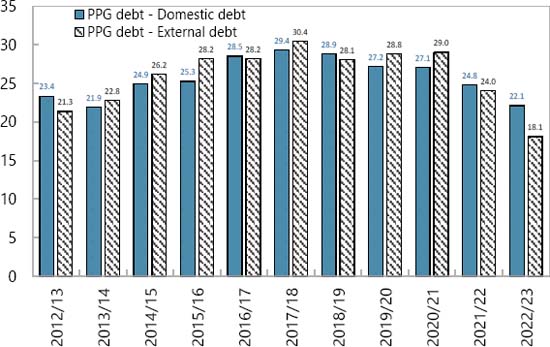

Shifting Debt Landscape

The government has reported improvements in its debt profile. Planning and Development Minister Fitsum Assefa (PhD) announced that Ethiopia had ceased relying on commercial loans and direct borrowing from the central bank.

She noted a significant drop in the external debt-to-GDP ratio to 13.7 per cent, though

the IMF’s Debt Sustainability Analysis, published in July 2024, pegged the ratio at 18

per cent as of June 2023.

External debt accounts for 45 per cent of Ethiopia’s total public and publicly guaranteed

debt, the report stated.

Financing Challenges Persist

Despite these reforms, Ethiopia’s financing challenges remain acute.

The government is seeking nearly USD 1 billion to complete the Koysha Hydroelectric

Dam project, which has stalled at two-thirds completion due to funding shortfalls.

The project is a critical component of Ethiopia’s development strategy, but its delays

underscore the broader fiscal pressures the country faces.

Expert Views on Economic Outlook

While Ethiopian officials are optimistic about the December review as a turning point,

analysts caution that real progress hinges on creditor consensus and the government’s

ability to implement reforms.

Critics have also raised concerns about inflated GDP growth figures, which they argue

may distort Ethiopia’s true debt sustainability.

Looking Ahead

The IMF review, coupled with Ethiopia’s active engagement with creditors, could mark a

a significant step forward in its quest for debt relief.

December will likely be a defining month for the country’s economic future, with broader

implications for its ability to attract investment and complete critical infrastructure

projects.

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

-

Business & Money8 months ago

Business & Money8 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics3 months ago

Politics3 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics2 months ago

Politics2 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics5 months ago

Politics5 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics5 months ago

Politics5 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics5 months ago

Politics5 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics4 months ago

Politics4 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money3 weeks ago

Business & Money3 weeks agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?