Business & Money

KCB Prevails in Land Dispute Against President Uhuru Kenyatta’s Cousins

The ruling in favour of KCB marks a significant milestone in Kenya’s legal history, setting a precedent for the resolution of similar disputes in the future. It reaffirms the judiciary’s role in upholding contractual rights and ensuring the equitable resolution of conflicts within commercial law.

: A Landmark Legal Victory for Kenya Commercial Bank validating the lender’s claims by upholding its rights as a secured creditor and affirming the validity of the land as collateral for the loan extended to the former President’s cousins 29 years ago.

: This long-standing legal dispute offers valuable lessons for lenders and borrowers alike. It underscores the importance of transparency, diligence, and adherence to legal protocols in all financial transactions.

By Charles Wachira

In a significant legal victory, Kenya Commercial Bank (KCB) emerged triumphant on May 27 from a protracted legal battle against Captain Kung’u Muigai and Ngengi Muigai, cousins of former President Uhuru Kenyatta. The dispute centred around a 443-acre piece of land that the duo had used as security for a loan obtained from KCB nearly three decades ago.

Background of the Dispute

The dispute’s origins date back 29 years when Captain Kung’u Muigai and Ngengi Muigai leveraged their landholding as collateral for a loan from KCB. However, complications arose as the years passed, leading to a legal standoff between the borrowers and the lending institution. The intricacies of the case involved questions regarding loan repayment, land ownership, and the validity of the security agreement.

Court Cases and Extended Conflict

The Muigai cousins and KCB engaged in a protracted legal battle during which both sides vehemently defended their positions in court. The proceedings were marked by complex legal reasoning, evidence presentation, and discussions aimed at resolving the contentious issues. As the case dragged on, it attracted widespread attention due to its high-profile nature and the involvement of individuals with close ties to Kenya’s political elite.

Landmark Ruling: KCB’s Triumph

After years of legal wrangling, the case culminated in the ruling, which unequivocally favoured KCB. The court’s decision validated the bank’s claims. It upheld its rights as a secured creditor, affirming the validity of the land as collateral for the loan extended to the Muigai cousins. The ruling represents a landmark victory for KCB, confirming the integrity of its lending practices and the enforceability of its contractual agreements.

Implications and Fallout

The ruling’s ramifications extend beyond the immediate parties involved, reverberating throughout Kenya’s legal and financial landscape. For KCB, the ruling reaffirms its standing as a reputable financial institution committed to upholding the rule of law and protecting its interests. Conversely, the ruling presents a setback for the Muigai cousins, highlighting the importance of fulfilling financial obligations and the consequences of defaulting on loan agreements.

Lessons Learned and Future Considerations

As the dust settles on this long-standing legal dispute, it offers valuable lessons for lenders and borrowers alike. It underscores the importance of transparency, diligence, and adherence to legal protocols in all financial transactions. Moreover, it serves as a reminder of the potential pitfalls of defaulting on loan obligations and the legal recourse available to creditors in such scenarios.

Conclusion: A Milestone in Legal History

Today’s ruling in favour of KCB marks a significant milestone in Kenya’s legal history, setting a precedent for the resolution of similar disputes in the future. It reaffirms the judiciary’s role in upholding contractual rights and ensuring the equitable resolution of conflicts within commercial law. As both parties digest the implications of the ruling, it underscores the enduring importance of accountability, integrity, and adherence to legal norms in Kenya’s evolving socio-economic landscape

Keywords:KCB Legal Victory:Land Collateral Dispute:Muigai Cousins:Loan Repayment Case:Kenyan Commercial Law Precedent

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

Business & Money

Top 10 Kenyan banks by total assets as of 2023, based on data from the Central Bank of Kenya:

KCB Bank Kenya Limited

Total Assets: KSh 1.425 trillion

Market Share: 17.4%

Equity Bank Kenya Limited

Total Assets: KSh 1.004 trillion

Market Share: 12.2%

NCBA Bank Kenya PLC

Total Assets: KSh 661.7 billion

Market Share: 9.2%

Co-operative Bank of Kenya

Total Assets: KSh 624.3 billion

Market Share: 8.8%

Absa Bank Kenya PLC

Total Assets: KSh 520.3 billion

Market Share: 6.6%

Standard Chartered Bank Kenya

Total Assets: KSh 429.3 billion

Market Share: 5.9%

Stanbic Bank Kenya

Total Assets: KSh 449.6 billion

Market Share: 5.8%

I&M Bank Limited

Total Assets: KSh 405.6 billion

Market Share: 5.4%

Diamond Trust Bank Kenya

Total Assets: KSh 399.6 billion

Market Share: 5.3%

Bank of Baroda (Kenya) Limited

Total Assets: KSh 201.9 billion

Market Share: 2.8%

These rankings illustrate the dominance of large Tier 1 banks, which collectively control over

76% of the market share. Strategic expansions, increased deposit mobilisation, and robust

lending practices underpin the sector’s strong performance

Business & Money

Vasundhara Oswal’s Legal Struggles and Family’s Plea for Justice

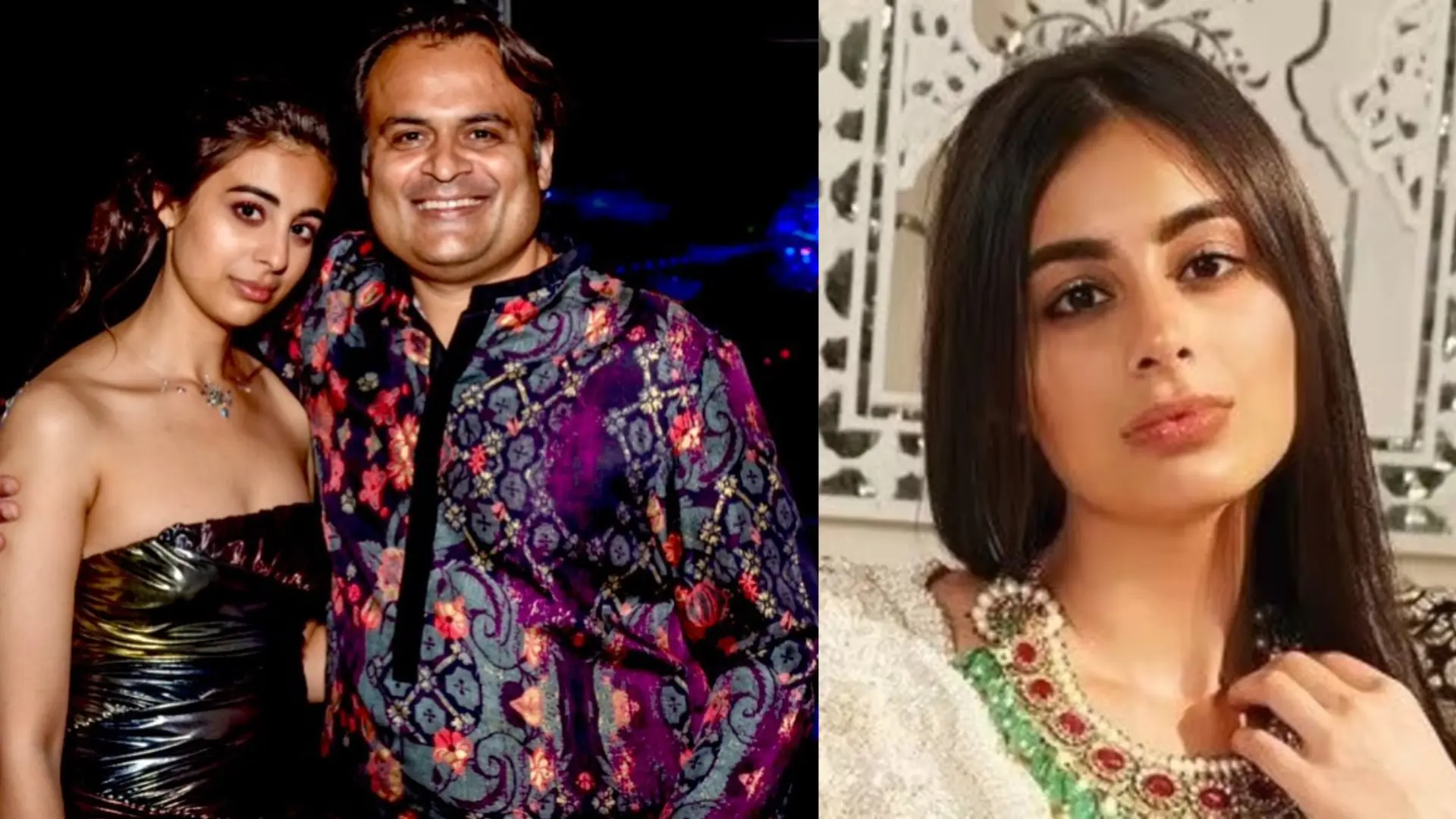

: Vasundhara Oswal, daughter of industrialist Pankaj Oswal, faces serious

charges in Uganda. The Oswals call for UN intervention amid claims of corporate

jealousy.

Vasundhara Oswal, the 26-year-old daughter of prominent Swiss-Indian industrialist

Pankaj Oswal, has found herself at the centre of a legal storm in Uganda.

Her father, a well-established business figure, is known for his diverse investments,

most notably a $150 million ethanol plant in Uganda.

This plant, the largest of its kind in East Africa, is a key part of Oswal’s broader strategy

to invest in industrial and eco-friendly solutions in the region. The facility produces extra-neutral alcohol (ENA), which is used in the beverage, cosmetics, and pharmaceutical industries.

It is recognised for its modern technology and sustainable practices, such as zero liquid

discharge, emphasising the Oswal family’s commitment to both industrial growth and

environmental responsibility.

In addition to the ethanol plant, Pankaj Oswal has made strategic investments across

various industries, including petrochemicals, agriculture, and real estate.

His ventures reflect a global reach, extending to Australia and India, where he has

been involved in industries ranging from agriculture to renewable energy.

His diversified business approach and commitment to sustainability have made him a prominent figure in international business. However, in October 2024, the family’s legacy was overshadowed by the legal troubles surrounding Vasundhara Oswal.

She was detained on October 1, 2024, after being accused of involvement in the

alleged murder of Mukesh Menaria, a former employee who had worked with the

Oswals since 2017.

Menaria had accused the family of harassment but later testified under oath that they

had not harmed him Despite this, charges of kidnapping and murder were brought against Vasundhara.

Her family has strongly denied these allegations, claiming that the charges are

politically motivated and part of a larger conspiracy orchestrated by their business rivals

in collaboration with corrupt officials in Uganda.

The Oswals have appealed to the United Nations, seeking intervention and asserting

that the legal proceedings against Vasundhara are unlawful. Vasundhara has actively managed the family business throughout her career, especially the ethanol plant, and led the company’s sustainable initiatives.

Beyond her business involvement, she has also been an advocate for community

welfare and mental health, further cementing the Oswal family’s reputation for corporate

social responsibility.

The unfolding legal drama has raised important questions about the intersection of

business, politics, and the legal systems in Uganda.

While the Oswal family’s ventures reflect a blend of industrial innovation and social

responsibility, the legal challenges Vasundhara faces have cast a shadow over their

business empire, highlighting the complex dynamics at play in East Africa.

-

Business & Money8 months ago

Business & Money8 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics3 months ago

Politics3 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics2 months ago

Politics2 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics4 months ago

Politics4 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics5 months ago

Politics5 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics5 months ago

Politics5 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics4 months ago

Politics4 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money1 week ago

Business & Money1 week agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?