Business & Money

Equity Group Holdings Declares Record Kshs 15.1 Billion Dividend

Looking ahead, Equity Group is strategically positioned in East Africa, a rapidly growing region with significant economic potential. Its diversified business model—encompassing banking, insurance, health, technology, and philanthropy—empowers the group to capitalise on growth opportunities, foster innovation, and enhance service delivery for a promising future.

: The Equity Group is pioneering positive outcomes for all with its Africa Recovery and Resilience Plan, visionary leadership, and strategic positioning.

By Charles Wachira

Equity Group Holdings has proudly announced a proposed record dividend of Kshs 15.1 billion (US$ 116,884,751) for the second consecutive year, a significant achievement that underscores its robust financial performance in 2023.

Dr James Mwangi, Group Managing Director and CEO, emphasised, “The Kshs. 4 per share dividend amounts to a 36% payout of the Kshs. 43.7 billion (S$ 338,269,114) profit after tax, or Kshs 11.1 earnings per share, and a dividend yield of 11.9% on the 2023 year-end closing share price of Kshs. 33.65, or 800% on par value.”

The financial results for 2023 underscored strong momentum, with net interest income growing by 21% to Kshs 104.2 billion (US$806,582,190) from Kshs 86 billion (US$665,701,232) and non-funded income registering an impressive 30% growth to Kshs 75.9 billion (US$587,520,040) from Kshs 58.3 billion (US$451,283,509).

A 106% rise in lending related to trade finance and a 26% increase in trade finance guarantees and off-balance sheet items drove a 90% increase in gross trade finance revenue to Kshs.11 billion (US$85,147,832) from Kshs.5.8 billion (US$44,961.24).

However, total costs escalated by 52% to Kshs 128.2 billion (US$992,359,278) from Kshs 84.5 billion (U$654,090,164), primarily due to a 139% rise in loan loss provisions to Kshs 32.8 billion (US$23,895,353) from Kshs 13.7 billion (US$106,047,744), aimed at bolstering asset quality buffers.

The depreciation of the Kenyan shilling and high inflation also caused a 28% increase in staff costs and a 39% increase in other operating expenses.

The return on average equity stood at 22.3%, exceeding the 18% cost of capital.

Profit after tax decreased by 5% to Kshs 43.7 billion (US$338,269,114) from Kshs 46.1 billion (US$ 356,846,823), mainly due to a 53% increase in interest expenses compared to a 30% growth rate in interest income.

With a 29% increase in customer deposits to Kshs 1.358 trillion (US$10,511,886,896) from Kshs 1.052 trillion (US$8,143,229,024), the group’s gross balance sheet increased by 26% to Kshs 1.821 trillion (US$14,095,836,552).

Shareholders’ funds increased by 20% to Kshs 218.1 billion (US$ 1,688,249,287) from Kshs 182.2 billion ( US$ 1,410,357,726).

The deployment of funding saw net loans rise by 26% to Kshs.887.4 billion (US$6,869,107,828) from Kshs.706.6 billion (US$5,469,587,099), while government securities holdings grew by 27% to Ksh 500.5 billion (US$3,874,226,356.00) from Kshs.394 billion ( US$ 3,049,840,528)

Cash and cash equivalents increased by 25% to Kshs 290.1 billion ( US$ 2,245,580,551) from Kshs 232.4 billion ( US$ 1,798,941,468).

Equity Group has demonstrated remarkable resilience, navigating challenges such as interest rate capping, the COVID-19 pandemic, global supply chain disruptions, and volatile global economic conditions, including FX volatility, high inflation, and interest rates.

Over the past seven years, amidst these adversities, customer numbers have surged to 19.6 million from 10.4 million, customer deposits have risen to Kshs.1.358 trillion (US$10,511,886,896) from Kshs.303.2 billion ( US$2,346,983,878), and the loan book has grown to Kshs.887.4 billion ( US$ 6,869,107,828) from Kshs.269.9 billion ( US$ 2,089,218,168). Total assets have soared to Kshs.1.822 trillion ( US$ 14,103,577,264) from Kshs.428.1 billion ( US$ 3,313,798,807), while shareholders’ funds have climbed to Kshs.218.1 billion ( US$ 1,688,249,287) from Kshs.72.1 billion ( US$ 561,089,494), a testament to the group’s stability and resilience.

Said Dr. Mwangi, “ The Group has navigated these challenges through a deliberate and strategic approach, reinforced by a robust risk management governance framework and a strong organisational culture emphasising innovation, customer-centricity, compliance, and prudent risk management.”

The Group achieved a PAR of 11.7%, improving from 12.2% in the third quarter and outperforming the industry NPL ratio of 14.8%.

Dr. Mwangi also noted, “The proactive derisking strategy involved providing for the lifetime expected loss on outstanding NPLs and increasing loan loss provisions by 139% to Kshs 32.8 billion (US$253,895,353) from Kshs 13.7 billion ( US$106,047,754), resulting in a cost of risk of 4.4% and an increased NPL coverage of 67.3% without guarantees and 90% with guarantees.”

Motivated by a vital mission and a risk management culture, Equity Group has received recognition through awards like the Oslo Business for Peace Award.

In addition, Brand Finance has named it the second-strongest global banking brand.

The group maintains strong risk buffers, 53.4% liquidity, and excellent asset quality. Its total capital-to-risk-weighted asset ratio of 18.1% exceeds the regulatory requirement of 14.5%.

The core capital to risk-weighted asset ratio stood at 14.3%, comfortably above the regulatory threshold of 10.5%, positioning the group well for its growth strategy.

Looking ahead, Equity Group is strategically positioned in one of the world’s fastest-growing regions, East Africa, which boasts significant economic potential. With a diversified business model encompassing banking, insurance, health, technology, and philanthropy, the group is set to capitalise on growth opportunities, innovate, and enhance its service delivery, a promising outlook for the future.

Dr. Mwangi concluded, “With clarity on our Africa Recovery and Resilience Plan, strong leadership, and strategic positioning, Equity Group is uniquely positioned to deliver positive outcomes for all stakeholders.”

Keywords:Record Dividend: Financial Performance: Asset Quality:Balance Sheet Growth:

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

Business & Money

Top 10 Kenyan banks by total assets as of 2023, based on data from the Central Bank of Kenya:

KCB Bank Kenya Limited

Total Assets: KSh 1.425 trillion

Market Share: 17.4%

Equity Bank Kenya Limited

Total Assets: KSh 1.004 trillion

Market Share: 12.2%

NCBA Bank Kenya PLC

Total Assets: KSh 661.7 billion

Market Share: 9.2%

Co-operative Bank of Kenya

Total Assets: KSh 624.3 billion

Market Share: 8.8%

Absa Bank Kenya PLC

Total Assets: KSh 520.3 billion

Market Share: 6.6%

Standard Chartered Bank Kenya

Total Assets: KSh 429.3 billion

Market Share: 5.9%

Stanbic Bank Kenya

Total Assets: KSh 449.6 billion

Market Share: 5.8%

I&M Bank Limited

Total Assets: KSh 405.6 billion

Market Share: 5.4%

Diamond Trust Bank Kenya

Total Assets: KSh 399.6 billion

Market Share: 5.3%

Bank of Baroda (Kenya) Limited

Total Assets: KSh 201.9 billion

Market Share: 2.8%

These rankings illustrate the dominance of large Tier 1 banks, which collectively control over

76% of the market share. Strategic expansions, increased deposit mobilisation, and robust

lending practices underpin the sector’s strong performance

Business & Money

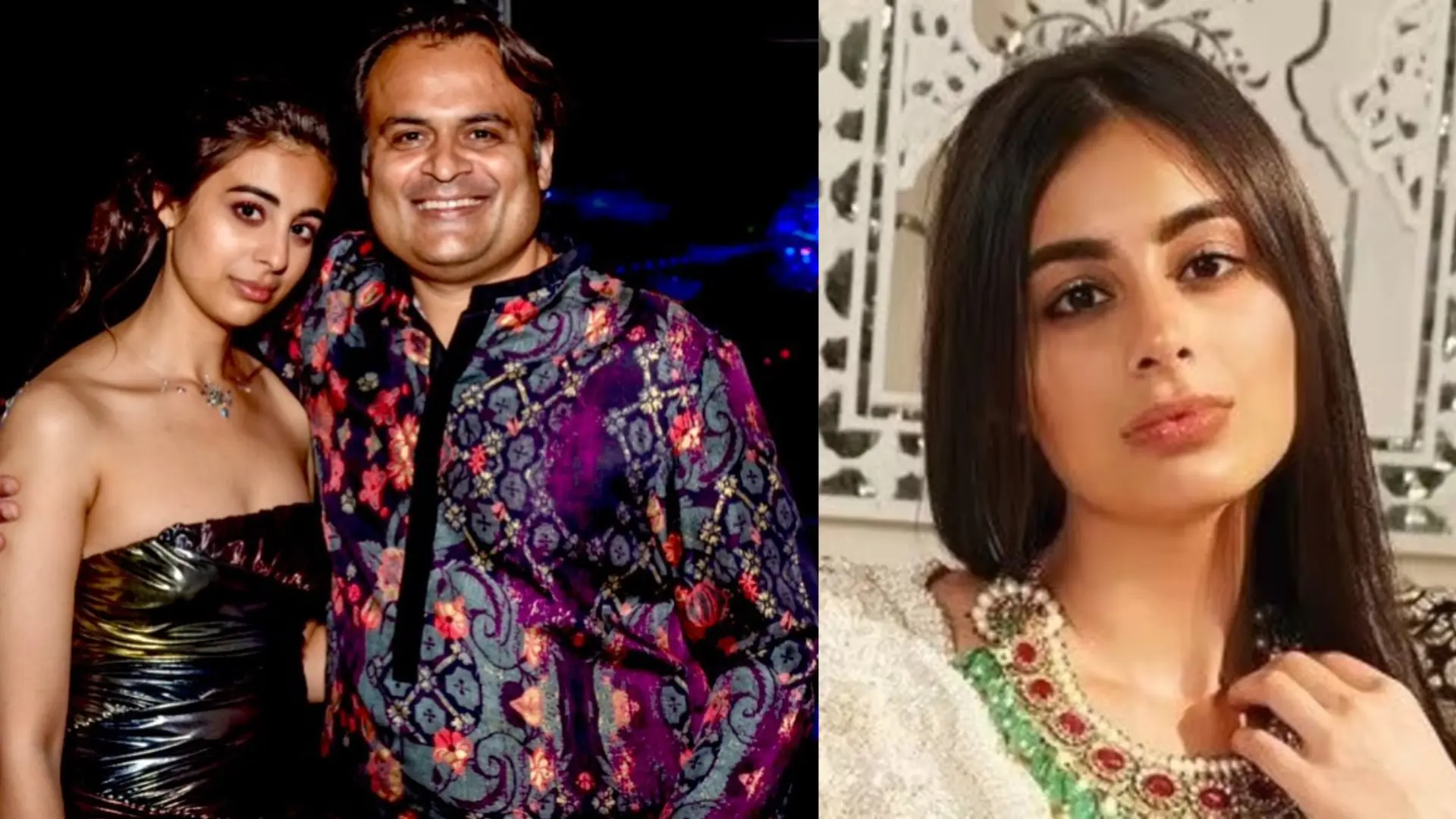

Vasundhara Oswal’s Legal Struggles and Family’s Plea for Justice

: Vasundhara Oswal, daughter of industrialist Pankaj Oswal, faces serious

charges in Uganda. The Oswals call for UN intervention amid claims of corporate

jealousy.

Vasundhara Oswal, the 26-year-old daughter of prominent Swiss-Indian industrialist

Pankaj Oswal, has found herself at the centre of a legal storm in Uganda.

Her father, a well-established business figure, is known for his diverse investments,

most notably a $150 million ethanol plant in Uganda.

This plant, the largest of its kind in East Africa, is a key part of Oswal’s broader strategy

to invest in industrial and eco-friendly solutions in the region. The facility produces extra-neutral alcohol (ENA), which is used in the beverage, cosmetics, and pharmaceutical industries.

It is recognised for its modern technology and sustainable practices, such as zero liquid

discharge, emphasising the Oswal family’s commitment to both industrial growth and

environmental responsibility.

In addition to the ethanol plant, Pankaj Oswal has made strategic investments across

various industries, including petrochemicals, agriculture, and real estate.

His ventures reflect a global reach, extending to Australia and India, where he has

been involved in industries ranging from agriculture to renewable energy.

His diversified business approach and commitment to sustainability have made him a prominent figure in international business. However, in October 2024, the family’s legacy was overshadowed by the legal troubles surrounding Vasundhara Oswal.

She was detained on October 1, 2024, after being accused of involvement in the

alleged murder of Mukesh Menaria, a former employee who had worked with the

Oswals since 2017.

Menaria had accused the family of harassment but later testified under oath that they

had not harmed him Despite this, charges of kidnapping and murder were brought against Vasundhara.

Her family has strongly denied these allegations, claiming that the charges are

politically motivated and part of a larger conspiracy orchestrated by their business rivals

in collaboration with corrupt officials in Uganda.

The Oswals have appealed to the United Nations, seeking intervention and asserting

that the legal proceedings against Vasundhara are unlawful. Vasundhara has actively managed the family business throughout her career, especially the ethanol plant, and led the company’s sustainable initiatives.

Beyond her business involvement, she has also been an advocate for community

welfare and mental health, further cementing the Oswal family’s reputation for corporate

social responsibility.

The unfolding legal drama has raised important questions about the intersection of

business, politics, and the legal systems in Uganda.

While the Oswal family’s ventures reflect a blend of industrial innovation and social

responsibility, the legal challenges Vasundhara faces have cast a shadow over their

business empire, highlighting the complex dynamics at play in East Africa.

-

Business & Money8 months ago

Business & Money8 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics3 months ago

Politics3 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics2 months ago

Politics2 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics4 months ago

Politics4 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics5 months ago

Politics5 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics5 months ago

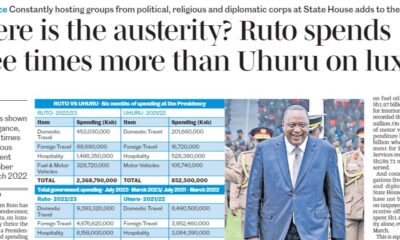

Politics5 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics4 months ago

Politics4 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money1 week ago

Business & Money1 week agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?