The Entrepreneur

The Inspiring Journey of Peter Kahara Munga: Founder of Equity Bank

“Equity was built on a simple idea: to provide financial access to those who had been left out. That mission is what kept us going during the tough times. If you start a business without a purpose, you will not have the conviction to see it through,”says Dr. Paul Kihara Munga

: Discover how Peter Munga founded Equity Bank with just Ksh 5,000 and transformed it into one of East Africa’s top financial institutions through resilience, innovation, and a focus on financial inclusion

By Charles Wachira

Peter Kahara Munga,aged 81, is a towering figure in Kenya’s financial landscape.He’s celebrated for his remarkable journey from humble beginnings to becoming one of the country’s wealthiest individuals.

Born in 1943 in Kangema,Central Kenya, Munga’s early life was marked by poverty. Yet, his determination and vision set him on a path to transformative success.

Munga’s educational journey was significantly supported by scholarships that allowed him to pursue his studies.

He began his education in a local primary school before completing his secondary education at Nyeri High School, a well-known institution in the region.

Munga later obtained diplomas in Human Resources and Financial Management, which laid the groundwork for his entrepreneurial endeavors.

Reflecting on the role of education, he once remarked, “Education opened doors for me that poverty would have otherwise closed. It gave me the foundation to dream bigger.”

In 1984, with just Ksh 5,000 as initial capital, Munga founded Equity Building Society (EBS) in Kangema. His mission was clear: to provide financial services to the underserved rural population, driven by a desire to combat poverty and promote economic inclusion.

“I wanted to create a financial institution that understood the needs of the ordinary Kenyan. I had seen firsthand how lack of access to credit kept many people in poverty,” Munga stated in an interview.

Despite his noble vision, Munga faced significant challenges. In the early 1990s, Equity Building Society encountered severe difficulties, including near insolvency due to a high percentage of non-performing loans.

However, Munga’s resilience and strategic leadership led to a remarkable turnaround.

Recognizing the need for fresh ideas, he recruited James Mwangi, who played a crucial role in revitalizing the institution.

By focusing on rural and low-income clients, Equity Bank distinguished itself from competitors that primarily catered to urban centers. This approach resonated with many, earning Equity the reputation of being “the people’s bank.”

The year 2004 marked a pivotal transformation in the history of Equity Building Society when it transitioned into a fully-fledged commercial bank, known as Equity Bank.

This strategic move was driven by the need for better access to capital and a broader range of financial products to meet the growing demands of its clientele. “Transforming into a bank allowed us to broaden our scope and offer more services, especially to those who had been excluded from formal banking for years,” Munga explained.

Equity Bank was later listed on the Nairobi Securities Exchange in 2006, marking a significant milestone in its growth and visibility in the financial market. Under Munga’s chairmanship, the bank expanded its footprint across East Africa, becoming one of the region’s largest and most influential financial institutions.

“Our growth was built on trust and understanding our clients. People want a bank that listens to them, a bank that is part of their community,” Munga observed.

Beyond banking, Munga founded several other enterprises, including Equatorial Nut Processors Limited and the Pioneer Group of Schools.

His commitment to education and community empowerment is evident through his philanthropic initiatives, particularly the “Wings to Fly” program, which offers scholarships to bright students from low-income backgrounds.

“Investing in education is not just about building the future of individuals; it is about building the future of a nation,” he said.

Despite his extraordinary success, Munga’s journey has not been without controversy. He has faced allegations of financial misconduct, including issues surrounding undervalued share transactions and unsecured loans linked to his connections within Housing Finance Bank.

Additionally, some of his properties have faced auction threats due to financial disputes.

But Munga remains unfazed by challenges, saying, “Every successful entrepreneur will face trials. The important thing is to learn from them and continue moving forward. Success is not about avoiding failure; it’s about how you respond to it.”

What Does It Take to Become a Successful Entrepreneur?

Peter Munga’s journey from a young boy in rural Kenya to the founder of one of East Africa’s largest banks has given him a wealth of wisdom on entrepreneurship. He believes that success is rooted in resilience, innovation, and an unwavering commitment to solving real problems.

“You must see opportunity where others see difficulty. Most people run away from problems; entrepreneurs run towards them,” he once said.

According to Munga, one of the essential traits for any entrepreneur is persistence. He often shares the story of how Equity Bank faced technical insolvency in the early 1990s.

“We were on the verge of collapse. Many would have given up. But I knew we had something valuable—a connection with the people. We just needed to find the right way to harness that potential,” he reflected.

He adds that this ability to remain focused on the goal, despite overwhelming odds, is what distinguishes successful entrepreneurs. “If you can persist when others quit, you will succeed,” he emphasizes.

Munga also underscores the importance of having a clear mission and purpose. He explains, “Equity was built on a simple idea: to provide financial access to those who had been left out. That mission is what kept us going during the tough times. If you start a business without a purpose, you will not have the conviction to see it through.”

Innovation is another key principle for Munga. As the bank began to grow, Munga recognized that it had to evolve to meet the changing needs of its clients.

“The market is always moving, and if you stay stagnant, you will be left behind. Entrepreneurs must innovate continuously, not just to stay relevant but to keep leading.”

Lastly, Munga stresses the value of integrity and building trust. “People do business with those they trust. If your customers trust you, they will stay with you through thick and thin. For us, Equity’s success was built on relationships, not just transactions.”

Legacy and Shareholding

As of now, Peter Munga holds approximately 5% stake in Equity Bank. This shareholding is significant, given his role as the founder and his long-standing influence in shaping the bank’s vision and operations since its inception. Munga’s commitment to the bank has not only established him as a prominent figure in Kenya’s financial sector but also allowed him to play a crucial part in the institution’s growth and expansion across East Africa.

Dr. Peter Kahara Munga’s story is one of resilience, innovation, and impact. His contributions to Kenya’s financial sector and philanthropic efforts continue to influence many, establishing him as a pivotal figure in transforming banking in East Africa.

Despite the controversies, his legacy as a visionary leader remains significant, embodying the spirit of perseverance and the drive to uplift others. Munga’s parting advice to budding entrepreneurs is simple: “Believe in your mission, work hard, and never give up. The road will be hard, but success always favors those who endure.”

The Entrepreneur

Miss Rwanda 2022, Divine Muheto, Faces Drink-Driving Scandal

: Miss Rwanda 2022, Divine Muheto, was arrested for drink-driving, fined, and

detained after a car crash. She expresses regret and seeks forgiveness for her

actions.

From Beauty Queen to Legal Controversy

Divine Muheto, 21, crowned Miss Rwanda 2022, rose to prominence as a symbol of

beauty and ambition. She always believed she had what it took to achieve her childhood

dream of becoming a beauty queen.

Her journey began after high school when she entered the Miss Rwanda competition,

ultimately claiming the coveted title.

Reflecting on her success, she once said, “When you fear, you can’t make anything

different in life, but when you are fearless, a lot of positive things come your way.”

Legal Troubles in 2024

However, her reign as Miss Rwanda has been overshadowed by controversy. In late

2024, Muheto was arrested following a drink-driving incident in Kigali.

Reports from the Rwanda National Police (RNP) confirmed that she was caught driving

under the influence of alcohol without a valid license, resulting in a crash that destroyed

public infrastructure, including a street light pole and palm trees.

The police also noted that Muheto fled the scene of the accident. She was subsequently

fined 190,000 Rwandan francs (approximately $140) and detained.

This incident marked a troubling pattern, as the beauty queen had previously faced

similar charges in September 2023, when she crashed her car into a building while

driving drunk.

Silent Remorse and Public Engagement

Muheto, the daughter of Assistant Commissioner of Police Francis Muheto, has

remained largely silent in the media following her arrest, though her legal team has

expressed that she deeply regrets her actions and has sought forgiveness.

Despite this, she continues to be a public figure, engaged in various activities. Her legal troubleshave raised concerns, but she remains resolute in her belief that life’s challenges present growth opportunities.

Inspirational Messages and Support System

While her parents have largely stayed out of the spotlight, Divine Muheto has continued

to inspire many young people in Rwanda, emphasising resilience and self-improvement.

She once said, “I knew I had what it takes to the last dot,” and even in the face of

adversity, she strives to move forward, learning from her mistakes and striving to make

a positive impact.

She Business

How Margaret Nyamumbo Built Kahawa 1893 from the Ground Up

: Discover Margaret Nyamumbo’s journey from Kenya to the U.S. and how she

built Kahawa 1893 to empower women coffee farmers, achieving business

success and social impact

Early Life and Education: Pursuing Global Opportunities

Margaret Nyamumbo’s entrepreneurial journey began in Kenya, where she grew up on a coffee

farm. However, she moved to the U.S., a decision that significantly shaped her path.

In 2000, she travelled to Smith College, a prestigious liberal arts institution in Massachusetts,

to study economics.

Her desire to study abroad stemmed from the limited educational opportunities available for

women in Kenya at the time. As she later explained, her family encouraged her decision, viewing it as a way to give her the best opportunities for success.

After earning her degree from Smith College, Nyamumbo pursued an MBA at the Wharton

School of the University of Pennsylvania, known for its rigorous business programs.

This solidified her foundation for a future in business, although it was the allure of her roots and a passion for coffee that eventually led her back to entrepreneurship.

From Corporate Work to Entrepreneurship: Embracing Coffee Culture

After completing her studies, Nyamumbo worked in investment banking and consulting, but the world of corporate finance didn’t fully satisfy her ambitions.

It was her return to the coffee industry, deeply connected to her Kenyan heritage, that drove

her entrepreneurial leap. With a vision to support East African coffee farmers, particularly women, Nyamumbo founded Kahawa 1893 in 2018, a coffee brand dedicated to highlighting Kenya’s coffee culture while mpowering local farmers.

The name “Kahawa” is the Swahili word for coffee, while “1893” marks the year when coffee

was first commercially grown in Kenya, grounding her brand in historical significance.

Through Kahawa 1893, Nyamumbo aimed to bring a new approach to the coffee business, one

that not only celebrated East African coffee but also created fair wages for farmers.

Building a Brand with Purpose: Empowering Farmers

Nyamumbo’s vision for Kahawa 1893 went beyond just selling coffee.

She wanted to create a direct impact on the lives of the farmers growing the coffee beans.

The brand’s model incorporated a system where customers could tip the farmers directly via a

QR code found on the coffee bags.

This innovation set the company apart from competitors and positioned it as a socially

responsible business that directly benefited those involved in the production process.

In 2021, Kahawa 1893 hit a major milestone, getting its coffee stocked in Trader Joe’s—the

first Black- and woman-owned coffee brand to be featured there.

This breakthrough moment was significant for Nyamumbo, marking the recognition of her hard work and her commitment to uplifting local farmers.

Overcoming Challenges: What It Takes to Succeed

Despite the challenges of entering a highly competitive market, Nyamumbo’s determination

never wavered. In a 2022 interview with Forbes, she shared her thoughts on what it takes to be a successful entrepreneur.

“You have to be able to take the punches and keep moving,” she said. Her advice reflects the

reality of entrepreneurship: persistence, resilience, and a willingness to learn from failure are

crucial for success.

Nyamumbo also emphasised the importance of passion. “You’ve got to love what you do, or you won’t have the energy to push through the tough times,” she said.

These values have guided her journey, driving Kahawa 1893 to not only succeed but also to

change the way the coffee industry operates, particularly about fair trade and community

empowerment.

The Future of Kahawa 1893: Expanding Horizons

With her success on platforms like Shark Tank and continued global distribution, Nyamumbo’s

Kahawa 1893 is poised for growth.

Her brand continues to expand its reach, and the emphasis on ethical sourcing, community

impact, and high-quality coffee will likely remain at the heart of her business model as she looks to further innovate in the global coffee market.

Through Kahawa 1893, Nyamumbo has shown that business success is not just about

profits—it’s about purpose, people, and passion.

The Entrepreneur

Paul Mburu Muthumbi: Building Kenya’s Mbukinya Bus Empire

Mbukinya faced tough early challenges: stiff competition, unreliable drivers, and high operating costs. Fuel price hikes and maintenance expenses cut into profits, and banks hesitated to fund small, high-risk PSV businesses. ‘There were days I doubted my choice,’ Paul Mburu recalls, ‘but I believed hard work would pay off.’”

Born and raised in Limuru, Kiambu County, Paul Mburu Muthumbi, now 90, has lived a life that exemplifies resilience and determination.

His story is not just one of personal triumph, but also a testament to the power of persistence in the face of adversity.

As a young man, Paul was passionate about the public transport sector, inspired by the buses that passed through his village. “I always knew I wanted to be involved in transport. I just didn’t know how,” he says.

In 1952, after completing his final exams, Paul found himself navigating the difficult job market.

In 1992, armed with little more than determination, Paul began hawking eggs in Nairobi’s busy streets, trying to make ends meet. “I knew that if I worked hard and kept my eyes open for opportunities, I could eventually do better,” he recalls.

It was in these early years of struggling in the informal sector that Paul learned crucial lessons about customer service, managing a small business, and the importance of reinvestment. “I used every penny from selling eggs to save for the next big step,” Paul explains.

Adding, “It wasn’t easy, but I knew that if I worked hard and kept my eyes open for opportunities, I could do better,” he recalls. Over the next 11 years, Paul saved KSh 6,000, which he used to invest in his first bus—a second-hand vehicle that would mark the beginning of his journey in the public transport sector.

The Birth of Mbukinya in 2000

In 2000, after nearly a decade of honing his entrepreneurial skills, Paul saw a potential opportunity in the public transport sector.

Nairobi, the capital city of Kenya, had a growing population, and reliable transportation services were in short supply. Recognizing the gap, he decided to take a bold leap and venture into the PSV industry.

With a small loan from a local microfinance bank, Paul bought his first second-hand bus.

The vehicle cost him KSh 800,000, an amount he managed to secure through a personal guarantee and a strong relationship with the local bank. “I didn’t have much collateral, but my reputation from my small egg business helped me convince the bank to lend me the money,” he says.

Paul registered Mbukinya, a name inspired by his family, and launched the business with a single bus operating on one route in Nairobi.

The early days were tough, with the bus struggling to fill seats and competition from well-established PSV companies. “The first few months were the hardest,” Paul admits.

“The industry was full of players, and many were set in their ways. But I believed in offering better service, and that’s how we started to build our reputation.”

Overcoming Early Challenges

The road ahead was fraught with challenges.

Mbukinya’s initial struggles included fierce competition, unreliable drivers, and high operational costs.

Paul recalls how fuel price fluctuations and maintenance costs often ate into the company’s meagre profits. “There were days when I wondered if I’d made the right choice. But I knew that with consistency and hard work, we could turn things around,” he says.

One of the biggest hurdles Paul faced was a lack of financing to expand his fleet.

In Kenya, many banks are reluctant to lend to new and small businesses, especially in the transport sector, which is viewed as high-risk.

“It was hard to get financial support from banks. They didn’t see the potential in PSV businesses back then,” Paul explains.

However, through persistence, he managed to secure another loan in 2003 from a local bank, this time amounting to KSh 1.5 million (US $.11,27.91).With this loan, he expanded his fleet to three buses.

“The key was to prove that I could repay the loans,” he says. “I made sure that Mbukinya’s buses were always well-maintained and on time. Punctuality became our trademark.”

Building a Reputation and Expanding the Fleet

By 2005, Mbukinya began to gain traction. Paul focused on customer satisfaction, ensuring his buses were clean, his drivers were professional, and the schedules were strictly adhered to.

“A happy passenger is a loyal passenger,” Paul reflects.

This commitment to service quickly paid off, and soon, the buses were consistently full, with more customers opting for his service over competitors.

To further build the company’s reputation, Paul expanded Mbukinya’s services to other major towns in Kenya.

By 2010, the company had expanded its fleet to 10 buses.

He used the profits from his expanding fleet to invest in modernising the buses, replacing older vehicles with newer, more fuel-efficient models. This move helped reduce operational costs, making the business more profitable.

In 2012, Mbukinya hit another milestone when it became one of the first PSV companies in Kenya to introduce an electronic payment system, allowing passengers to pay via mobile money platforms like M-Pesa.

This tech-forward move attracted a new generation of commuters who valued convenience.

Navigating Economic Turmoil and the Role of Banks

As with any business, the road wasn’t always smooth.

In 2015, Kenya’s PSV industry underwent a major regulatory shift. The government introduced new licensing and inspection requirements, which required operators like Paul to invest in fleet upgrades and adhere to stricter safety standards.

“It was a tough time for all of us in the industry,” Paul recalls. “The new regulations meant significant investments in safety equipment and training. But I saw this as an opportunity to differentiate Mbukinya from other operators.”

Despite the financial strain, Paul’s good relationship with banks helped him secure the necessary funding to meet the new regulations.

“The banks saw that we were committed to the business and to complying with regulations. They helped us get through those challenging times,” he says.

In 2018, Paul was able to secure a larger loan to purchase 15 more buses, growing the fleet to over 30 vehicles. His strong ties with financial institutions, built on years of consistent business practices, allowed him to access capital that many of his competitors struggled to obtain.

A Crisis with the Hino Kenya Buses

Despite the steady growth and success, Mbukinya faced a significant setback in 2019. The company had acquired 41 Toyota Hino buses, which had initially seemed like a smart investment.

However, soon after their acquisition, the buses developed severe mechanical problems, causing a major disruption in Mbukinya’s operations. The buses, which were still within their warranty period, posed a serious challenge to the company.

To address the issue, Mbukinya returned the buses to Toyota, who assumed ownership and took on the responsibility of repairing them.

According to Muthumbi, he received KSh 60 million for the buses, but he emphasised that this amount did not fully cover the massive losses the company incurred.

“I had invested billions into those buses, and the repairs took a toll on our finances. It was a huge setback,” Paul explains.

The incident was particularly painful for Mbukinya, as the company had put significant faith in the vehicles, which were expected to bolster the fleet and improve operational efficiency.

The crisis put a strain on Mbukinya’s reputation and finances, requiring both tactical responses and long-term strategy changes.

The Night Ban Controversy

In addition to the challenges with the buses, Paul Mburu Muthumbi also found himself at odds with the National Transport and Safety Authority (NTSA) over the controversial night travel ban.

In December 2013, NTSA introduced a policy restricting public service vehicles from operating between 10 pm and 5 am, citing safety concerns due to accidents during late-night travels.

This decision was met with resistance from several PSV operators, including Muthumbi, who felt that the ban was unfairly detrimental to his business.

“The night ban hit our income hard. Losing those nighttime routes meant a significant drop in revenue,” he explains.

As the chairman of the Kenya Country Bus Owners’ Association (KCBOA), Muthumbi was a vocal critic of the policy.

He even threatened to take legal action to have the ban nullified, arguing that it unfairly affected many small PSV operators who relied on night services to stay competitive.

“We’re being punished for an issue that isn’t fully in our control,” Paul said at the time. “We’ll fight this ban in court if necessary, as it directly threatens our livelihoods.”

These challenges were particularly daunting, but they didn’t deter Muthumbi. Instead, he continued to press forward, proving his resilience in the face of adversity.

His ability to navigate these difficult situations further solidified his reputation as a determined entrepreneur in Kenya’s highly competitive transport sector.

Giving Back and the Road Ahead

Today, Mbukinya operates a fleet of 50 buses, covering multiple routes across Kenya and employing over 200 people.

Paul’s story is a testament to his resilience and vision. Beyond business, he has given back to his community, sponsoring educational programs and offering employment to many young Kenyans.

“I’ve always believed that success isn’t just about making money; it’s about lifting others along the way,” says Paul, who has invested in training programs for his staff and offered financial support to local schools.

Looking to the future, Paul is planning further expansions, with a focus on sustainability.

“I want Mbukinya to be a company that not only leads in transport but also sets the standard for environmental responsibility. We’re looking into green technologies like electric buses in the next five years,” he says.

From hawking eggs to running a transport empire, Paul Mburu Muthumbi’s story shows that with vision, resilience, and a willingness to embrace change, success is always within reach.

-

Business & Money8 months ago

Business & Money8 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics3 months ago

Politics3 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics2 months ago

Politics2 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics4 months ago

Politics4 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics5 months ago

Politics5 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

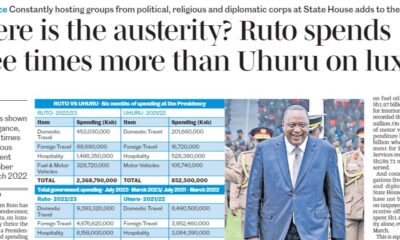

Politics5 months ago

Politics5 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics4 months ago

Politics4 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money1 week ago

Business & Money1 week agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?