Business & Money

Inside the Fraud: The Movement of Sh322 Million Equity Bank Loot to Abu Dhabi

The Kenya Financial Reporting Centre (FRC) has frozen several local accounts connected to the fraud and is working with international authorities to recover the stolen Sh322 million. However, the recovery process remains challenging due to the cross-border transfer of funds and the suspects’ efforts to obscure their tracks.

: Unraveling the Equity Bank Fraud: A Deep Dive into Cybercrime and Money Laundering in Abu Dhabi

By Charles Wachira

Introduction:

In a stunning revelation, the intricate web of fraudulent activities involving Equity Bank has emerged, exposing a sophisticated operation that transferred Sh322 million out of Kenya to Abu Dhabi. Orchestrated by a group of cybercriminals, this scheme has raised nationwide concerns about vulnerabilities within Kenya’s banking sector.

Details of the Fraud:

Between June 15 and July 30, 2024, cybercriminals executed a meticulously planned heist targeting Equity Bank, siphoning off Sh322 million from various accounts. This unprecedented breach reveals significant lapses in the bank’s security protocols and raises questions about regulatory oversight. Equity Bank CEO James Mwangi condemned the breach, stating, “This incident is a stark reminder of the evolving threats banks face in the digital age. We are working tirelessly to enhance our security measures and mitigate risks.”

Financial Impact:

The financial implications are severe, with Sh322 million in customer funds unaccounted for. This loss not only impacts individual depositors but also undermines confidence in Kenya’s banking system, affecting investor sentiment and economic stability.

Investigation and Legal Ramifications:

The Directorate of Criminal Investigations (DCI) has launched a thorough investigation, collaborating with international agencies to trace the funds’ movement. Detective Chief Inspector Jane Mugo affirmed, “We are pursuing leads both domestically and internationally to apprehend the perpetrators and recover the stolen funds.” Legal experts anticipate a protracted battle, particularly concerning the extradition of suspects from Abu Dhabi.

Response from Authorities:

The Central Bank of Kenya (CBK) has mandated all banks to review and enhance their cybersecurity measures. Governor Dr. Kamau Thugge emphasized, “Enhancing cybersecurity resilience is paramount to safeguarding the integrity of our financial system. We urge all banks to remain vigilant and proactive.”

Industry Reactions and Future Outlook:

Industry analysts predict increased scrutiny from regulatory bodies and heightened investment in cybersecurity across the banking sector. Cybersecurity expert Dr. Susan Chege remarked, “This incident underscores the critical need for banks to invest in robust cybersecurity frameworks.”

Key Figures Involved:

The following individuals are believed to have played pivotal roles in orchestrating the heist and transferring the stolen funds to Abu Dhabi:

- Maurice Mbugua Kihara (Ringleader): The alleged mastermind is currently at large, suspected to have fled to Abu Dhabi, where part of the stolen money was transferred. His connections with international financial networks have facilitated the swift transfer of funds. Kenyan authorities have issued an international arrest warrant via Interpol.

- Ruth Nyambura Mwangi (Cybersecurity Expert): A key player in the cyber attack, she is also believed to have escaped to Abu Dhabi. Her expertise enabled unauthorized access to the bank’s accounts. An Interpol Red Notice has been issued for her as well.

- Martin Thuo Kamau (Money Mule): Another central figure, he is suspected of laundering the stolen funds through multiple accounts in Kenya and internationally. His whereabouts are unclear, with investigators suspecting he may be hiding in the UAE or another jurisdiction.

- Jane Wambui Muthoni (Local Account Facilitator): She is believed to have helped establish domestic bank accounts used to launder the money and may have insider knowledge that facilitated the breach.

- Samuel Kimani Muiruri (Fake ID Provider): He is accused of providing fake identification documents for opening fraudulent accounts, crucial for ensuring the anonymity of the perpetrators.

- Unknown International Collaborators in Abu Dhabi: Investigators have identified the involvement of unidentified collaborators in Abu Dhabi who assisted in laundering the money.

Mechanism of the Fraud:

Here’s a detailed breakdown of how the money was moved:

- Cyber Breach and Unauthorized Access: Using advanced cybercrime techniques, the suspects hacked into Equity Bank’s internal systems, allowing them to initiate multiple unauthorized transfers without triggering security alerts.

- Transferring Funds through Local Accounts: The group transferred funds to a network of domestic accounts under false identities and shell companies, evading detection by making small transactions.

- Conversion of Funds into Different Currencies: The stolen funds were converted into currencies such as U.S. dollars and UAE dirhams, facilitating their usability in the international market, particularly in Abu Dhabi.

- Layering the Money: Engaging in classic money laundering tactics, the criminals moved the funds through multiple accounts and institutions to obscure their origins, using international collaborators to facilitate the movement.

- Transferring Funds to Abu Dhabi: The laundered funds were moved to Abu Dhabi through a combination of international wire transfers, cryptocurrency, and possibly hawala, avoiding traditional banking channels.

- Money Laundering through Investments or Business Fronts: Once in Abu Dhabi, the stolen funds may have been invested in local businesses or high-end real estate to blend into the legal economy, complicating recovery efforts.

Current Status of the Investigation:

The DCI has launched a manhunt for the suspects, many of whom are believed to have fled the country. Authorities have requested Interpol’s assistance in tracking down Maurice Mbugua Kihara and Ruth Nyambura Mwangi, complicating efforts to bring them to justice. Detective Chief Inspector Jane Mugo stated, “We are pursuing every possible lead, both locally and internationally, to ensure that these individuals are brought to justice.”

The Kenya Financial Reporting Centre (FRC) has frozen several local accounts linked to the fraud and is cooperating with international authorities to recover the stolen Sh 322 million. While recovery is possible, it presents a complex challenge due to the international movement of funds and the suspects’ efforts to cover their tracks.

Key Steps for Recovery:

- Freezing Local and International Bank Accounts: Immediate action is needed to freeze accounts linked to the fraud, with cooperation from international agencies essential for recovering funds abroad.

- Tracing the Money Trail through International Financial Channels: Investigators must meticulously trace the movement of funds, working with international financial intelligence units to track the stolen money.

- Diplomatic Efforts and Extradition: Extraditing suspects from Abu Dhabi is crucial for recovering the stolen funds, requiring diplomatic negotiations and legal procedures.

- Collaboration with International Authorities: Ongoing cooperation with international financial authorities and law enforcement is vital for tracking down the stolen funds and bringing the perpetrators to justice.

While challenges persist, authorities remain committed to uncovering the full extent of the fraud and recovering the stolen funds

Keywords:Equity Bank Fraud:Cybercrime:Money Laundering:Abu Dhabi: Investigation

Business & Money

Ethiopia Attracts $53.5 Million in Q1 Investments, Creates 8,700 Jobs

: Ethiopia attracts $53.5M in Q1 investments, creating 8,700 jobs. Growth driven

by reforms, with a focus on service and manufacturing sectors.

The Addis Ababa Investment Commission (AAIC) announced a promising start to the

2023/24 fiscal year, with 612 investors registering a combined capital of Birr 2.93 billion

($53.5 million) in the first quarter.

This reflects a 13% growth compared to the same period last year, signalling sustained

investor confidence despite economic challenges.

Speaking at a press briefing on November 30, AAIC’s Director of Communication,

Meseret Woldemariam, credited the growth to policy reforms and enhanced investor

facilitation.

“Our efforts to streamline investment processes and resolve bottlenecks are yielding

results. We remain committed to ensuring investors thrive in Addis Ababa,” she said.

SECTORIAL CONTRIBUTIONS

The majority of the newly licensed investors are in the service and manufacturing

sectors. The service sector includes hotels, tourism, and IT ventures, while the manufacturing

investments span electrical products, steel, wood, and textiles.

These investments have generated 8,707 jobs, comprising 770 permanent and 490

temporary positions created by newly licensed entities.

The AAIC has also initiated field monitoring visits to ensure operational readiness. “Our

team works closely with new investors to address challenges promptly, enabling faster

project rollout,” Meseret added.

CHALLENGES AND REFORMS

Investors continue to face hurdles such as foreign currency shortages and workspace

availability. However, the commission highlighted progress due to macroeconomic reforms,

particularly improving foreign currency access.

“We are actively collaborating with the Mayor’s office to address workspace issues

through professional support in rental solutions and operational guidance,” Meseret

explained.

Recent reforms in the National Bank of Ethiopia’s foreign exchange policy have also

been pivotal. In October, the central bank announced a 30% increase in forex allocation to priority sectors, a move welcomed by stakeholders.

EXPANSION PLANS AND PROJECTIONS

The AAIC aims to capitalise on the momentum, targeting Birr 15 billion ($274 million) in

investments by the end of the fiscal year. A new digital investment portal, launched in November, promises to reduce registration times by 40% and improve transparency.

“We are confident these initiatives will not only attract more investors but also deepen

the trust of existing ones,” Meseret concluded.

INVESTOR SENTIMENT

Prominent business leader Ahmed Yusuf, who recently launched a $3 million IT hub in

Addis Ababa, praised the commission’s efforts.

“The improvements in investor services and forex allocation are encouraging. We hope

to see more streamlined processes for licensing and operations,” he remarked.

As Ethiopia seeks to position itself as a regional investment hub, sustained efforts in

addressing investor concerns and enhancing infrastructure will be critical.

Business & Money

Ethiopia Eyes December Debt Restructuring After IMF Review

: Ethiopia’s December IMF review may unlock long-awaited debt restructuring,

crucial for economic reforms and stalled projects like the Koysha Hydroelectric

Dam.

Ethiopia’s much-anticipated debt restructuring prospects could gain clarity this

December, as the country awaits the second review under its four-year International

Monetary Fund (IMF) program.

The Extended Credit Facility (ECF), launched in August 2023, remains central to

Ethiopia’s economic reform and debt relief efforts.

Progress Toward Debt Treatment

Last week, Ethiopian authorities reached a staff-level agreement with the IMF tied to the

second review. A comprehensive report on this review is set for release in December, a month many stakeholders, including the National Bank of Ethiopia (NBE), view as pivotal for

advancing debt treatment plans.

“Debt restructuring stands at the centre of our reform agenda. With the report’s release,

we expect rescheduling talks to gain momentum,” said Habtamu Workneh, Director of

External Economic Analysis & International Relations at the NBE.

He added that discussions are focusing primarily on extending maturity dates for Ethiopia’s debts.

IMF Support and Engagements with Creditors

The IMF has provided Ethiopia with USD 2.5 billion under its current fiscal program,

offering critical support to the country’s macroeconomic stabilisation efforts.

In parallel, Ethiopian authorities have engaged with Eurobond holders and the Official

Creditors Committee (OCC).

A debt restructuring proposal was submitted to Eurobond holders in July 2024, following

key discussions in December 2023 and May 2024.

Additionally, a global investor update held on October 1, 2024, highlighted the nation’s

ongoing economic challenges and progress in creditor negotiations.

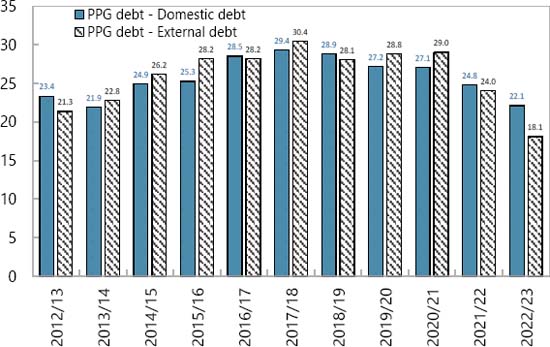

Shifting Debt Landscape

The government has reported improvements in its debt profile. Planning and Development Minister Fitsum Assefa (PhD) announced that Ethiopia had ceased relying on commercial loans and direct borrowing from the central bank.

She noted a significant drop in the external debt-to-GDP ratio to 13.7 per cent, though

the IMF’s Debt Sustainability Analysis, published in July 2024, pegged the ratio at 18

per cent as of June 2023.

External debt accounts for 45 per cent of Ethiopia’s total public and publicly guaranteed

debt, the report stated.

Financing Challenges Persist

Despite these reforms, Ethiopia’s financing challenges remain acute.

The government is seeking nearly USD 1 billion to complete the Koysha Hydroelectric

Dam project, which has stalled at two-thirds completion due to funding shortfalls.

The project is a critical component of Ethiopia’s development strategy, but its delays

underscore the broader fiscal pressures the country faces.

Expert Views on Economic Outlook

While Ethiopian officials are optimistic about the December review as a turning point,

analysts caution that real progress hinges on creditor consensus and the government’s

ability to implement reforms.

Critics have also raised concerns about inflated GDP growth figures, which they argue

may distort Ethiopia’s true debt sustainability.

Looking Ahead

The IMF review, coupled with Ethiopia’s active engagement with creditors, could mark a

a significant step forward in its quest for debt relief.

December will likely be a defining month for the country’s economic future, with broader

implications for its ability to attract investment and complete critical infrastructure

projects.

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

-

Business & Money9 months ago

Business & Money9 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics4 months ago

Politics4 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics3 months ago

Politics3 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics6 months ago

Politics6 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics6 months ago

Politics6 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics6 months ago

Politics6 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Business & Money2 months ago

Business & Money2 months agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?

-

Politics5 months ago

Politics5 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead