Technology

Safaricom Ethiopia to Offer Full Coverage in Eastern Ethiopia by End of October

Safaricom Ethiopia’s milestone of achieving full coverage in eastern Ethiopia by the end of October signifies not only the rapid expansion of the company but also a broader shift in Ethiopia’s telecom industry

: Safaricom Ethiopia to achieve full coverage in eastern Ethiopia by October 2024, marking a major milestone in its expansion two years after launch

By Charles Wachira

Safaricom Telecommunications Ethiopia is set to achieve full coverage of eastern Ethiopia by the end of October, a crucial milestone for the telecom giant, which launched operations in the country just two years ago. This move comes as part of the company’s broader expansion strategy, which aims to provide nationwide service by the time its 15-year operating license reaches the halfway point in 2028.

Executives at Safaricom Ethiopia, the Ethiopian arm of Kenya’s Safaricom PLC, shared this development during a press briefing in Addis Ababa, emphasizing the importance of expanding telecom access to underserved regions. “We are proud to announce that by the end of this month, we will be offering complete coverage across eastern Ethiopia. This is a significant achievement for us, and it marks another important step in our journey to bring connectivity to all Ethiopians,” said Anwar Soussa, CEO of Safaricom Telecommunications Ethiopia.

Accelerating Expansion

Safaricom Ethiopia was awarded a 15-year license in May 2021 after paying $850 million, making it the first private telecom operator in the country, which had long been dominated by state-owned Ethio Telecom. By October 2022, the company had officially launched its services in Addis Ababa, serving about 1 million customers in the first month.

Since then, the company has been aggressive in expanding its footprint across Ethiopia’s vast landscape, where connectivity had long been a challenge, particularly in rural areas. Today, Safaricom Ethiopia boasts over 4.6 million subscribers across the country, with a focus on delivering affordable, reliable, and high-quality mobile services.

“Our commitment from day one has been to extend coverage to every corner of this beautiful country,” Soussa remarked. “Our investment is not just in infrastructure, but in the people of Ethiopia. We’re working hard to bring digital inclusion to all regions, including those that have historically been left behind.”

Economic and Social Impact

This expansion into eastern Ethiopia, a region with over 25 million people, represents more than just increased telecom access—it’s part of a broader effort to stimulate economic activity. Improved mobile connectivity is expected to enhance local businesses, foster mobile banking, and boost access to digital platforms that can transform sectors like agriculture and education.

According to figures shared by Safaricom Ethiopia, the company has invested over $1 billion in network infrastructure since entering the market. The deployment of 4G and 5G networks, in particular, is expected to drive data usage and enable faster, more efficient communication across the region.

“As we continue to build our network, we are also mindful of the socio-economic impact of our services,” Soussa noted. “Connectivity is key to unlocking new opportunities for businesses and individuals, and we are proud to contribute to Ethiopia’s digital transformation.”

Looking Ahead

Safaricom Ethiopia’s aggressive expansion plan aligns with the Ethiopian government’s ongoing liberalization of the telecom sector, which is seen as a catalyst for the country’s broader economic reforms. The government has indicated that it plans to sell a 40% stake in Ethio Telecom in the coming years, further opening up the market to competition.

By the end of 2024, Safaricom aims to have deployed over 5,000 network towers across Ethiopia, reaching a coverage rate of over 75% of the population. The company is also looking into launching mobile financial services in the near future, pending regulatory approval from the National Bank of Ethiopia.

As Safaricom continues its rapid growth, challenges remain, particularly in regions with difficult terrain and security concerns. However, the company remains committed to its long-term vision for the Ethiopian market.

“Our 15-year license is more than just an entry into a new market—it’s a commitment to Ethiopia’s future. We are here for the long haul, and we’re excited to see what the next decade brings,” Soussa concluded.

With full coverage of eastern Ethiopia imminent, Safaricom Telecommunications Ethiopia is on course to become a key player in the country’s telecom landscape, reshaping the way millions of Ethiopians connect and communicate.

Conclusion

Safaricom Ethiopia’s milestone of achieving full coverage in eastern Ethiopia by the end of October signifies not only the rapid expansion of the company but also a broader shift in Ethiopia’s telecom industry. With substantial investments and a vision for digital inclusion, Safaricom’s efforts will likely accelerate the country’s economic growth and digital transformation. The success of the company’s rollout will be closely watched, both within Ethiopia and across the African continent, as other nations consider similar liberalization efforts.

Keywords:Safaricom Ethiopia expansion:Full coverage eastern Ethiopia:Ethiopian telecom market:Safaricom 2024 milestone:Telecom industry growth Ethiopia

Technology

Kenya & Mauritius Lead East Africa’s Cybercrime Battle

: Kenya and Mauritius face rising DDoS attacks, topping East Africa. Discover

what drives these threats and how nations are fortifying defences.

Kenya and Mauritius are increasingly becoming hotspots for cybercrime in East Africa,

according to the recently released NETSCOUT 1H2024 DDoS Threat Intelligence

Report (TIR).

Both countries recorded the highest volumes of Distributed Denial-of-Service (DDoS)

attacks in the region, with cybercriminals deploying increasingly sophisticated, multi-

vector techniques to disrupt services.

DDoS SURGE IN KENYA AND MAURITIUS

Bryan Hamman, Regional Director for Africa at NETSCOUT, emphasised the growing

threat.

“Kenya and Mauritius are bearing the brunt of DDoS attacks in East Africa. Attackers

are not only increasing the volume but also leveraging multi-vector approaches that

make detection and mitigation far more challenging,” Hamman explained.

In Kenya, where the tech ecosystem thrives on innovations such as M-Pesa and

expansive mobile banking services, the Communications Authority of Kenya (CA)

reported a 12% increase in cyberattacks in the first half of 2024, translating to 459

million incidents.

Similarly, Mauritius, recognised as a financial hub, saw a sharp rise in attacks on its

financial services sector, a key contributor to its GDP.

WHAT DRIVES THE TARGETTING OF KENYA AND MAURITIUS?

Technological Advancement:

Both nations are at the forefront of digital transformation in East Africa, which,

while driving economic growth, also exposes vulnerabilities. Hamman noted,

“The more interconnected these economies become, the larger the attack

surface for cybercriminals.”

Economic Significance:

Kenya’s dominance as a regional tech hub and Mauritius’s role in global financial

services make them prime targets for malicious actors seeking to exploit high-

value systems.

Insufficient Cybersecurity Infrastructure:

Despite advancements, gaps in cybersecurity frameworks persist. For instance,

Kenya’s Data Protection Act of 2019 and Mauritius’s cybersecurity strategy have

struggled to keep pace with the sophistication of modern cyber threats.

COMPARISON WITHIN EAST AFRICA

While Kenya and Mauritius grapple with these challenges, regional peers like Rwanda

and Tanzania have demonstrated resilience.

- ● Rwanda: Known for its proactive measures, such as the National Cyber Security

- Authority (NCSA), Rwanda has kept DDoS incidents relatively low. In the first half

- of 2024, the country reported only 36 million attacks.

- ● Tanzania: With the establishment of its Computer Emergency Response Team

- (CERT) in 2020, Tanzania has reduced phishing and ransomware incidents by

- 35% and 20%, respectively.

IMPACT OF CYBERCRIME

The repercussions are severe, affecting sectors critical to economic stability:

● Kenya: The banking and telecommunications sectors, central to the country’s

GDP, have faced significant disruptions. Safaricom reported a two-hour outage in

April 2024 linked to a DDoS attack, costing millions in lost revenue.

● Mauritius: The financial services industry has suffered data breaches and

operational downtimes, undermining investor confidence.

RECOMMENDATIONS FOR ACTION

Enhanced Cybersecurity Policies:

Governments must update regulations to reflect evolving threats. Public-private

partnerships can also drive innovation in defence mechanisms.

Regional Collaboration:

Establishing an East African Cyber Defense Alliance could enable nations to

share threat intelligence and resources.

Investment in Education and Awareness:

Cyber hygiene training for individuals and businesses can help minimize

vulnerabilities, particularly against phishing attacks and social engineering

tactics.

Adoption of Advanced Technologies:

Leveraging tools like AI-driven threat detection can provide real-time responses

to attacks.

CONCLUSION

As cybercriminals grow bolder and more sophisticated, Kenya and Mauritius must

accelerate efforts to fortify their defences. “A regional approach that blends technology,

policy, and awareness is key to turning the tide against these threats,” Hamman

concluded.

The path forward is clear: a united East African front, coupled with robust internal

reforms, can transform the region from a target to a cybersecurity stronghold.

Technology

MTN Uganda Reports 29.6% Profit Rise to Shs 459.4bn in 2024

MTN Uganda’s revenue from mobile data and MoMo services jumped over 20% year-on-year, driven by growing demand for digital financial solutions and a strong focus on expanding MoMo’s reach.

: MTN Uganda’s profit climbs by 29.6% to Shs 459.4bn for 2024’s first nine months, driven by digital growth, fintech, and network expansion strategies.

MTN Uganda reported a 29.6% increase in profit after tax, reaching Shs 459.4 billion for the first nine months of the year, compared to Shs 354.5 billion during the same period in 2023.

This growth reflects the telecom giant’s strategic focus on expanding digital services and enhancing network coverage to capture more market share in Uganda’s competitive telecommunications sector.

CEO Cites Strategic Expansion and Digital Focus

Chief Executive Officer Sylvia Mulinge attributed the profit jump to effective cost management and a strong emphasis on digital transformation.

“Our increased investment in infrastructure and focus on digital financial services continue to yield positive results, as seen in this remarkable growth,” she stated during the earnings release.

Fintech and Data Services Lead Revenue Growth

Mobile data and MTN Mobile Money (MoMo) services played a significant role, as revenue from these segments has grown by over 20% year-on-year.

With Uganda’s demand for digital financial solutions rapidly increasing, MTN Uganda’s focus on expanding MoMo has led to a substantial boost in customer uptake, contributing to a large portion of this year’s growth.

Investments in Network Infrastructure Pay Off

MTN Uganda’s ongoing investments in 4G and 5G network infrastructure have also proven profitable.

In 2024, the company increased its capital expenditure to Shs 200 billion, up from Shs 160 billion in 2023, to meet the growing demand for faster and more reliable internet. “MTN Uganda has successfully captured the increased demand for reliable and faster internet,” said Henry Tumusiime, a telecom analyst based in Kampala. “Their proactive approach to enhancing data service capabilities has kept them ahead, especially as the economy becomes more digitised.”

Youth-Focused Campaigns Expand Subscriber Base

MTN’s early 2024 campaign aimed at youth — offering affordable data bundles and free educational content — attracted over 500,000 new users, expanding its subscriber base to 17 million, up from 16.5 million in 2023. This campaign has been instrumental in further driving revenue growth.

Outlook: Commitment to Quality and Digital Inclusion

Looking forward, MTN Uganda remains focused on delivering high-quality, affordable services to enhance digital inclusion. “As we approach year-end, our strategy remains anchored on delivering quality service, ensuring affordability, and growing digital inclusion,” Mulinge added.

MTN Uganda’s performance aligns with MTN Group’s broader strategy to connect Africa and strengthen digital finance solutions across the continent.

Technology

Skyleader 600 Launch in Tanzania: Boosting Local Aircraft Manufacturing

The Skyleader 600 marks a pivotal moment for Tanzania, not only in aviation but in its broader industrial aspirations.

With its maiden landing at Julius Nyerere International Airport, the aircraft stands as a symbol of Tanzania’s growing capacity to innovate, manufacture, and compete on the global stage.

Discover Tanzania’s aviation breakthrough with the Skyleader 600, the first locally manufactured ultralight aircraft, unveiled at TIMEXPO 2024 in Dar es Salaam

By Charles Wachira

In a groundbreaking achievement for Tanzania and Africa’s aviation sector, AIRPLANE Africa Limited (AAL), based in Morogoro, launched the Skyleader 600, marking the first ultralight aircraft manufactured in the country.

The official unveiling took place at TIMEXPO 2024 in October 2024, setting a new milestone for local manufacturing and economic potential.

The Skyleader 600: A Game-Changer in African Aviation Designed with business travelers in mind, the Skyleader 600 can carry two passengers, offering a cost-effective alternative for long-distance travel.

The aircraft is praised for its modern design, affordability, and low maintenance costs.

Powered by petrol fuel, it addresses the growing demand for accessible and efficient transportation across Tanzania and the wider African market.

AAL’s Director, David Grolig, proudly remarked at the launch, “This is a historic moment not just for AIRPLANE Africa Limited, but for Tanzania. We have built something that will change the way people travel in this country and beyond.”

His statement reflects the company’s larger vision to transform Tanzania into a key player in ultralight aircraft manufacturing in Africa.

From Morogoro to the Skies: AAL’s Journey The journey to the Skyleader 600 began in 2019, when AIRPLANE Africa Limited was established in Morogoro.

The company blended local Tanzanian expertise with Czech aviation technology, a country renowned for its ultralight aircraft production.

This strategic collaboration has fostered a new generation of Tanzanian aviation professionals, thanks to internships and training programs designed to enhance skills and create jobs.

“The partnership with Czech aviation experts was crucial,” said Grolig. “It’s a blend of global expertise and local ambition. We’re showing that when we work together, we can achieve remarkable things.”

This combination has allowed AAL to tailor the Skyleader 600 to meet the unique needs of Africa’s business and private aviation sectors.

TIMEXPO 2024: Showcasing Tanzanian Innovation The TIMEXPO 2024 trade fair in Dar es Salaam served as the launch platform for the Skyleader 600.

This event, which highlights Tanzanian manufacturing, drew attention from global exhibitors and dignitaries.

The Minister for Industry and Trade was in attendance, noting the significance of AAL’s achievement: “This is a symbol of what we can achieve when we invest in our local industries. The government is committed to supporting such initiatives as they create jobs, foster innovation, and help us become more self-reliant.”

The launch has bolstered Tanzania’s image as a country capable of innovation, especially in high-tech sectors like aviation.

The Skyleader 600 is expected to open new economic opportunities in tourism, pilot training, and aircraft maintenance services.

Government Support and Economic Impact The Tanzanian government’s collaboration with AIRPLANE Africa Limited and its European partners has been key to the success of the Skyleader 600.

Support from regulatory authorities and the provision of trade incentives reflect the government’s commitment to fostering local industries that reduce reliance on imports.

Grolig acknowledged the government’s role, stating, “We couldn’t have done this without their backing. The government’s support has been essential in moving from concept to reality.”

This partnership is a model for public-private collaboration, particularly in industries like aviation that require significant investment and expertise.

Economic Potential and Future Growth The Skyleader 600’s production is expected to create ripple effects across Tanzania’s economy, from aviation services to job creation.

It provides an affordable transportation solution, not only for Tanzania but also for neighboring African markets.

AAL has ambitious plans to commercially sell the Skyleader 600, with Grolig hinting at future developments: “This is just the start. We plan to expand production, develop new models, and make Tanzania a leader in ultralight aircraft manufacturing in Africa.”

A Vision for the Future The Skyleader 600 represents a turning point for Tanzania, not just in aviation but in its broader industrial ambitions.

As the aircraft begins operations after its maiden landing at Julius Nyerere International Airport, it symbolizes Tanzania’s potential to innovate, manufacture, and compete on the global stage.

In a world where aviation is dominated by Western and Asian manufacturers, Tanzania, through AIRPLANE Africa Limited, is making its mark with the Skyleader 600—an ultralight aircraft that carries the hopes of a nation into the skies. Keywords: Skyleader 600 launch Tanzania ultralight aircraft manufacturing in Africa AIRPLANE Africa Limited TIMEXPO 2024 aviation showcase Tanzanian aviation industry growth

Keywords:Skyleader 600 launch Tanzania:Ultralight aircraft manufacturing in Africa: AIRPLANE Africa Limited:TIMEXPO 2024 aviation showcase:Tanzanian aviation industry growth

-

Business & Money9 months ago

Business & Money9 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics4 months ago

Politics4 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics3 months ago

Politics3 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics6 months ago

Politics6 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics6 months ago

Politics6 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics6 months ago

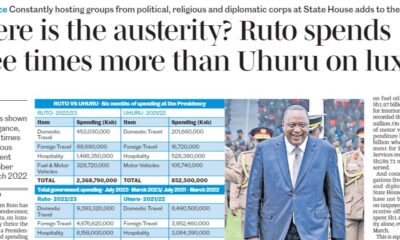

Politics6 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics5 months ago

Politics5 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money1 month ago

Business & Money1 month agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?