Business & Money

Ben Chumo Ensnared in KSh 40 Million Land Dispute

The case revolves around a prime piece of land in Kitengela, Kajiado County, which businessman Philip Kiptum sold to Ben Chumo for KSh 40 million in 2020. However, Edna Jeptoo, the estranged wife of Kiptum claims the land, valued at KSh 50 million, was part of their matrimonial estate and was sold without her consent to hide assets ahead of their divorce settlement.

: Former Kenya Power MD Ben Chumo became entangled in a Kajiado land dispute after purchasing a KSh 40 million Kitengela property, now at the centre of a high-profile divorce battle between businessman Philip Kiptum and his estranged wife, Edna Jeptoo.

By Charles Wachira

Former Kenya Power Managing Director, Ben Chumo, has become embroiled in a high-profile divorce dispute between Philip Kiptum, a prominent businessman, and his estranged wife, Edna Jeptoo. The case revolves around a prime piece of land in Kitengela, Kajiado County, which Kiptum sold to Chumo for KSh 40 million in 2020. However, Jeptoo claims the land, valued at KSh 50 million, was part of their matrimonial estate and was sold without her consent in an effort to hide assets ahead of their divorce settlement.

The Contested Land and Transaction

The disputed Kitengela property became a focal point of the legal battle when it emerged that Kiptum had sold it to Chumo during the couple’s ongoing divorce proceedings. Jeptoo’s legal team accused Kiptum of intentionally orchestrating the sale to diminish her rightful share of the couple’s joint assets. She insisted that the land was part of their matrimonial estate, a claim that complicated the transaction and eventually led to a court battle.

Kiptum, a businessman with significant investments in real estate development and commercial farming, defended the sale, arguing that the land was not intended to be part of the matrimonial assets. He maintained that the sale to Chumo was a legitimate business transaction conducted within his normal business operations.

Ben Chumo’s Involvement

Ben Chumo, who had made the land purchase as a business investment, found himself drawn into the legal dispute when Jeptoo challenged the sale. Represented by lawyer Mutula Kilonzo Jr., Chumo argued that he had entered the deal in good faith, unaware of any ongoing matrimonial dispute over the property. His legal team asserted that the transaction followed all legal protocols and was handled through proper channels.

“My client, Mr. Chumo, was approached by Mr. Kiptum as an investor interested in acquiring the Kitengela property. The purchase was made following legal procedures, and he had no knowledge of any matrimonial claims related to the land,” Kilonzo Jr. told the court during proceedings.

Jeptoo’s Claims and Court Proceedings

Jeptoo, however, presented a different narrative. She claimed that the sale was a deliberate attempt by Kiptum to hide matrimonial assets and deprive her of her rightful share. In her court filings, she accused Kiptum of undervaluing the property by selling it for KSh 40 million, despite its actual value being KSh 50 million. Jeptoo argued that the land was part of their joint investments and that her husband had sold it without her knowledge or consent.

Her legal team urged the court to void the sale, arguing that it was conducted in bad faith and without full disclosure. They sought to have the land included in the matrimonial estate and subject to division as part of the couple’s divorce settlement.

Court Ruling and Ownership Status

After months of legal proceedings, Justice Maureen Odero delivered her ruling in late 2023. The court found that the Kitengela land was indeed part of the matrimonial estate and that Kiptum had sold the property without proper consultation or disclosure to Jeptoo. Justice Odero nullified the sale to Chumo, ruling that the property should be returned to the matrimonial estate for equitable division between Kiptum and Jeptoo.

However, the court recognized that Chumo had acted in good faith, unaware of the ongoing dispute. As a result, he was awarded KSh 40 million in compensation for the canceled transaction, to be paid by Kiptum. Additionally, Kiptum was ordered to cover Chumo’s legal costs resulting from the dispute.

Current Ownership of the Land

Following the court’s ruling, the Kitengela property is now part of the matrimonial estate of Philip Kiptum and Edna Jeptoo. While the land remains in joint ownership for the time being, its eventual division is expected as part of the ongoing divorce settlement. Both parties will have to reach an agreement or await further court orders regarding any future sale or development of the property.

Business Background of Philip Kiptum

Kiptum is a well-known businessman with a portfolio of investments in real estate and agriculture. His real estate ventures focus on acquiring and developing properties in fast-growing areas such as Kitengela. He is also involved in commercial farming, supplying agricultural products both locally and internationally. The sale of the Kitengela land to Chumo was part of his real estate dealings, which have come under scrutiny due to the legal battle with Jeptoo.

Public Reaction and Implications

The ruling has sent ripples through Kenya’s real estate and business communities, highlighting the risks associated with property deals that involve matrimonial disputes. While Chumo has been exonerated, his involvement in the high-profile case has brought attention to the importance of due diligence in property transactions, especially when disputes over ownership are present.

For Kiptum, the ruling has dealt a blow to his public image, with the court finding that he attempted to conceal assets from his wife. Jeptoo, on the other hand, has been vindicated in her claim, with the court affirming her right to a share of the contested property.

As the Kitengela land returns to the marital estate, the next phase of the divorce case will focus on dividing the remaining assets. Still, the controversy surrounding the property has left a lasting mark on the proceedings.

Keywords: Ben Chumo land dispute: Kitengela property battle: KSh 40 million land sale: Philip Kiptum divorce case: Kajiado County real estate

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

Business & Money

Top 10 Kenyan banks by total assets as of 2023, based on data from the Central Bank of Kenya:

KCB Bank Kenya Limited

Total Assets: KSh 1.425 trillion

Market Share: 17.4%

Equity Bank Kenya Limited

Total Assets: KSh 1.004 trillion

Market Share: 12.2%

NCBA Bank Kenya PLC

Total Assets: KSh 661.7 billion

Market Share: 9.2%

Co-operative Bank of Kenya

Total Assets: KSh 624.3 billion

Market Share: 8.8%

Absa Bank Kenya PLC

Total Assets: KSh 520.3 billion

Market Share: 6.6%

Standard Chartered Bank Kenya

Total Assets: KSh 429.3 billion

Market Share: 5.9%

Stanbic Bank Kenya

Total Assets: KSh 449.6 billion

Market Share: 5.8%

I&M Bank Limited

Total Assets: KSh 405.6 billion

Market Share: 5.4%

Diamond Trust Bank Kenya

Total Assets: KSh 399.6 billion

Market Share: 5.3%

Bank of Baroda (Kenya) Limited

Total Assets: KSh 201.9 billion

Market Share: 2.8%

These rankings illustrate the dominance of large Tier 1 banks, which collectively control over

76% of the market share. Strategic expansions, increased deposit mobilisation, and robust

lending practices underpin the sector’s strong performance

Business & Money

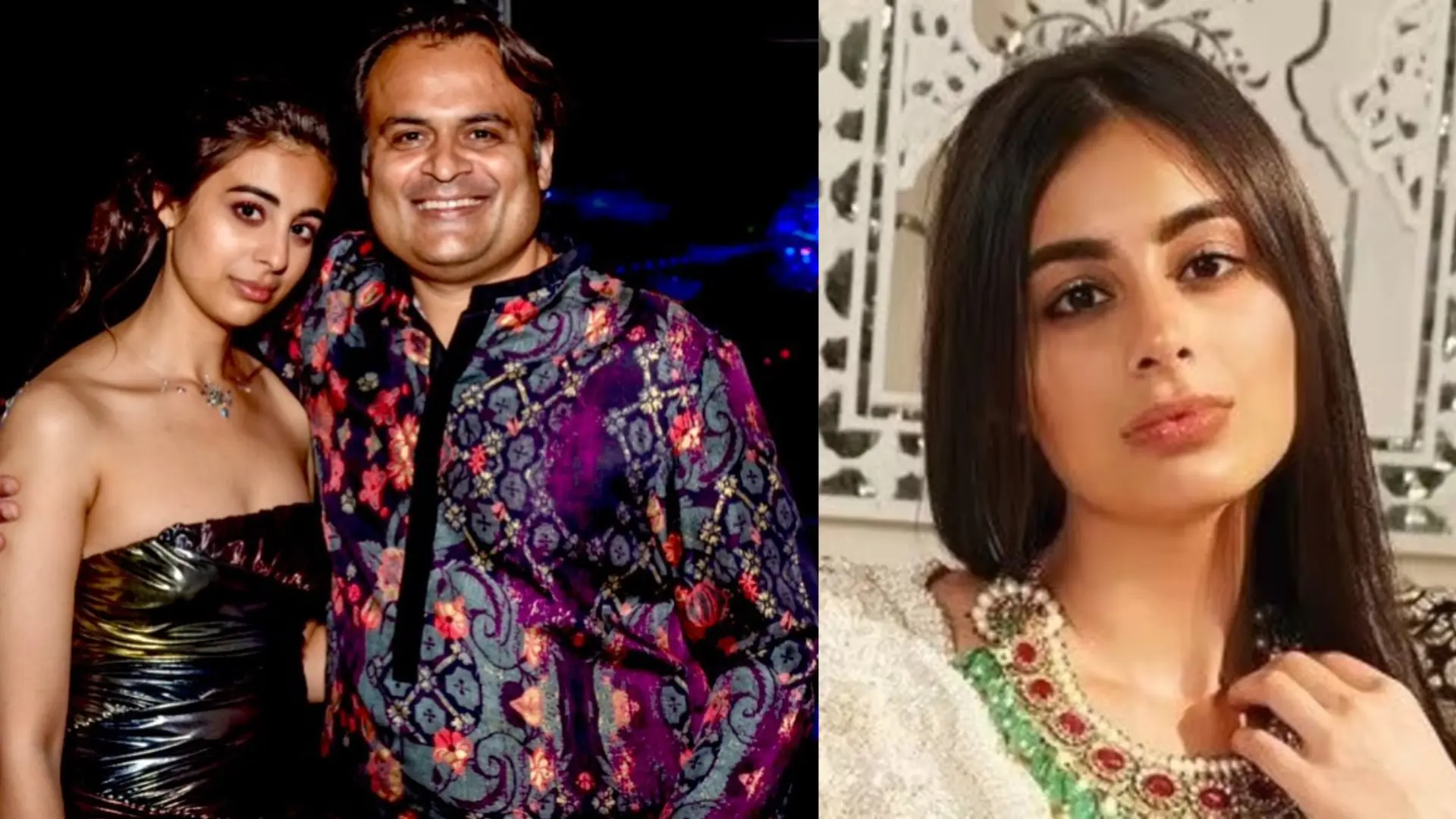

Vasundhara Oswal’s Legal Struggles and Family’s Plea for Justice

: Vasundhara Oswal, daughter of industrialist Pankaj Oswal, faces serious

charges in Uganda. The Oswals call for UN intervention amid claims of corporate

jealousy.

Vasundhara Oswal, the 26-year-old daughter of prominent Swiss-Indian industrialist

Pankaj Oswal, has found herself at the centre of a legal storm in Uganda.

Her father, a well-established business figure, is known for his diverse investments,

most notably a $150 million ethanol plant in Uganda.

This plant, the largest of its kind in East Africa, is a key part of Oswal’s broader strategy

to invest in industrial and eco-friendly solutions in the region. The facility produces extra-neutral alcohol (ENA), which is used in the beverage, cosmetics, and pharmaceutical industries.

It is recognised for its modern technology and sustainable practices, such as zero liquid

discharge, emphasising the Oswal family’s commitment to both industrial growth and

environmental responsibility.

In addition to the ethanol plant, Pankaj Oswal has made strategic investments across

various industries, including petrochemicals, agriculture, and real estate.

His ventures reflect a global reach, extending to Australia and India, where he has

been involved in industries ranging from agriculture to renewable energy.

His diversified business approach and commitment to sustainability have made him a prominent figure in international business. However, in October 2024, the family’s legacy was overshadowed by the legal troubles surrounding Vasundhara Oswal.

She was detained on October 1, 2024, after being accused of involvement in the

alleged murder of Mukesh Menaria, a former employee who had worked with the

Oswals since 2017.

Menaria had accused the family of harassment but later testified under oath that they

had not harmed him Despite this, charges of kidnapping and murder were brought against Vasundhara.

Her family has strongly denied these allegations, claiming that the charges are

politically motivated and part of a larger conspiracy orchestrated by their business rivals

in collaboration with corrupt officials in Uganda.

The Oswals have appealed to the United Nations, seeking intervention and asserting

that the legal proceedings against Vasundhara are unlawful. Vasundhara has actively managed the family business throughout her career, especially the ethanol plant, and led the company’s sustainable initiatives.

Beyond her business involvement, she has also been an advocate for community

welfare and mental health, further cementing the Oswal family’s reputation for corporate

social responsibility.

The unfolding legal drama has raised important questions about the intersection of

business, politics, and the legal systems in Uganda.

While the Oswal family’s ventures reflect a blend of industrial innovation and social

responsibility, the legal challenges Vasundhara faces have cast a shadow over their

business empire, highlighting the complex dynamics at play in East Africa.

-

Business & Money8 months ago

Business & Money8 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics3 months ago

Politics3 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics2 months ago

Politics2 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics5 months ago

Politics5 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics5 months ago

Politics5 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics5 months ago

Politics5 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics4 months ago

Politics4 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money1 week ago

Business & Money1 week agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?