Business & Money

Multinationals Retreat from Africa: Challenges in Kenya, SA, Nigeria

The depreciating value of currencies has made it increasingly challenging for multinationals to repatriate profits. In the past decade, Nigeria’s naira has fallen by 88% against the dollar, while the Kenyan shilling has decreased by 34%, and the South African rand has seen a decline of 44%.

Explore why multinationals like Nestlé and Unilever are retreating from Africa due to economic challenges in Kenya, South Africa, and Nigeria

Nestlé SA announced the cessation of production for Nesquik chocolate milk powder in South Africa in August 2023, attributing this decision to declining demand.

A year prior, Unilever Plc halted the manufacturing of home-care and skin-cleansing products in Nigeria to “sustain profitability.”

Pharmaceutical giants Bayer AG and GSK Plc have also outsourced the distribution of their products to independent firms in Kenya and Nigeria.

Over the past few decades, numerous top multinationals have flocked to Africa, attracted by rapid growth, youthful populations, and rising wealth.

However, recent challenges—including plummeting currencies, excessive bureaucracy, unreliable power, and congested ports—have diminished the region’s appeal.

“It doesn’t justify the effort,” remarks Kuseni Dlamini, a former chairman of Walmart Inc.’s African unit, who now leads the American Chamber of Commerce in South Africa. “This should be a wake-up call to African authorities. If you do not have a conducive environment to grow and scale businesses, you will be left by the wayside.”

The retreat of multinationals is most evident in Kenya, South Africa, and Nigeria, the trio of countries typically targeted for initial ventures into the region. Together, they represent 44% of sub-Saharan Africa’s economy and approximately 30% of its population.

This hesitation to expand or maintain current operations frustrates African leaders striving to alleviate unemployment and lessen their dependence on commodities as economic drivers.

President William Ruto of Kenya has stated that manufacturing could elevate the country to middle-income status by 2030, yet poor infrastructure and growing regulation have undermined competitiveness and stunted economic growth. Nestlé, which had contemplated increasing production in Kenya, is instead scaling back operations at its sole facility there.

While it will continue producing select items like Maggi noodles, it is downgrading parts of the facility to package imported foods like Cerelac baby cereal.

In January 2024, Neumann Gruppe GmbH, the world’s largest coffee trader, announced plans to shut down its Kenyan mill and a unit that provided financial and marketing support to small farmers, retaining only its operation that sources coffee beans for export.

The company noted that jobs would be lost, although it did not specify the number, attributing this move to a 2022 government decree that barred companies from both marketing coffee and grinding the beans, compelling them to choose one or the other.

Companies in Kenya are also grappling with increased taxes, particularly a levy on imports of essential raw materials such as cement, metals, and paper.

The Kenya Association of Manufacturers reported that last September, 53% of its members were operating at a quarter of their capacity or less, with 42% anticipating job cuts within six months.\

“All the numbers are negative,” stated Anthony Mwangi, CEO of the Kenya Association of Manufacturers, which represents both domestic and foreign firms. “Those spaces that were used for production, now they are empty spaces. There are warehouses that are importing the same stuff.”

Since 2016, major South African retailers like Mr Price, Shoprite, and Truworths have exited Nigeria, a market they once prioritized for international growth.

Last year, Unilever ceased production of Omo washing powder, Sunlight dishwashing liquid, and Lux soap in Nigeria, opting instead to import these products. In March, Nestlé’s local unit reported its first nine-month loss in twelve years following a significant decline in the local currency.

In South Africa, the continent’s most advanced economy, the once-praised infrastructure has deteriorated.

Power outages have become nearly daily occurrences, while water shortages are rising, with up to 40% of water lost to leaks in some urban networks.

Multinationals have also pointed to a convoluted work permit system that complicates the hiring of foreign executives.

The South African-German Chamber of Commerce stated last year that delays were jeopardizing operations owned by German companies responsible for 100,000 jobs in the country.

“The visa matter spans the entire hierarchy of German business in South Africa,” the group said in a statement. “This is of course not only a concern to German business but also to the country itself.”

The regular production interruptions and the scaling back of manufacturing pose significant challenges for local retailers.

Shoprite Holdings Ltd., Africa’s largest supermarket chain, has had to ramp up its stockpiles to prevent empty shelves, and is constructing additional distribution centers to accommodate more goods.

“This gives you an idea of how constrained the supply chain is,” noted Shoprite CEO Pieter Engelbrecht. “There’s very little investment in production capacity in South Africa amongst the manufacturers, and the multinationals have completely stopped.”

The declining value of currencies has further complicated multinationals’ ability to repatriate profits. Over the past decade, Nigeria’s naira has depreciated by 88% against the dollar, while the Kenyan shilling has weakened by 34%, and the South African rand has dropped by 44%.

This has resulted in diminished spending power for residents, especially concerning imported goods or those containing foreign components.

In response, local manufacturers are increasingly providing more affordable alternatives that replicate global brands.

South Africa’s Bliss Brands (Pty) Ltd. has long marketed its MAQ washing powder in poorer townships surrounding major cities.

Today, this brand is increasingly available at Shoprite’s Checkers outlets and Pick n Pay Stores in affluent suburbs—priced nearly 30% lower than Unilever’s Omo and Skip detergents.

While MAQ hasn’t always been the cheapest option compared to international competitors, it has managed to keep price increases in check, according to Moaz Shoaib Iqbal, a director at Bliss.

“Our structure is more nimble,” he explained. Multinationals are “relying on the equity of their brands to carry them through.”

This retreat has opened the door for lower-cost producers from other emerging nations to challenge the dominant brands with their own manufacturing facilities in Africa.

In Nigeria, locally produced diapers from a Turkish manufacturer are beginning to outpace Procter & Gamble Co.’s Pampers, while a ramen product from a Singapore firm is displacing Nestlé’s Maggi noodles.

“In Africa, the market for pricier items is dwindling,” said Alec Abraham, an analyst at Sasfin Securities in Johannesburg. “We are seeing a shift in ranges to suit more basic needs, which means fewer items as manufacturers match their ranges to income levels.”

Keywords: Multinationals: Africa: Economic challenges:Kenya: Unilever.

Business & Money

KCB Group Surpasses Equity with US$ 342.31 Million Nine-Month Profit

: KCB Group reports Sh44.5B ( US$ 342.31) nine-month profit, outpacing

Equity Bank. Learn about its 49% growth, challenges, and stock performance this

year.

KCB Group Plc has outperformed Equity Bank to cement its position as Kenya’s leading

lender, posting a net profit of Sh44.5 billion for the nine months ending September

This represents a 49% year-on-year growth, surpassing Equity Bank’s Sh37.5

billion profit during the same period.

Profit Growth Driven by Core Business Performance

The remarkable profit growth was fueled by higher earnings from both interest and non-

interest income streams. KCB’s diverse revenue base has been pivotal in maintaining

its dominance in the competitive banking sector.

Non-Performing Loans a Key Concern

Despite the impressive profit growth, KCB’s non-performing loan (NPL) ratio rose to

18.5%, compared to 16.5% last year. This increase highlights persistent challenges in

managing credit risk, with Chief Financial Officer Lawrence Kimathi acknowledging it as

a “pain point” for the bank.

KCB Stock Outshines Peers on NSE

KCB’s strong financial performance has translated into exceptional stock market results.

The bank’s stock has risen 78.8% year-to-date, making it the best-performing banking

stock on the Nairobi Securities Exchange (NSE).

Plans to Sell National Bank of Kenya

Earlier this year, KCB announced plans to sell its struggling subsidiary, National Bank of

Kenya (NBK), to Nigeria’s Access Bank. While Nigerian regulators have approved the

deal, it is still awaiting clearance from Kenya’s Central Bank. The sale aims to

streamline KCB’s operations and address losses at NBK.

CEO Paul Russo Optimistic About Year-End Performance

“The journey has not been without its hurdles, but our ability to walk alongside our

customers has driven our success,” said KCB CEO Paul Russo. He expressed

confidence in closing the year on a high note, leveraging improving economic conditions

across the region.

Key Figures at a Glance

● Net Profit: Sh44.5 billion (+49%)

● Non-Performing Loan Ratio: 18.5% (up from 16.5%)

● Stock Performance: +78.8% year-to-date

KCB’s strong performance underscores its resilience in navigating challenges and its

commitment to sustaining growth in Kenya’s banking sector.

Business & Money

Top 10 Kenyan banks by total assets as of 2023, based on data from the Central Bank of Kenya:

KCB Bank Kenya Limited

Total Assets: KSh 1.425 trillion

Market Share: 17.4%

Equity Bank Kenya Limited

Total Assets: KSh 1.004 trillion

Market Share: 12.2%

NCBA Bank Kenya PLC

Total Assets: KSh 661.7 billion

Market Share: 9.2%

Co-operative Bank of Kenya

Total Assets: KSh 624.3 billion

Market Share: 8.8%

Absa Bank Kenya PLC

Total Assets: KSh 520.3 billion

Market Share: 6.6%

Standard Chartered Bank Kenya

Total Assets: KSh 429.3 billion

Market Share: 5.9%

Stanbic Bank Kenya

Total Assets: KSh 449.6 billion

Market Share: 5.8%

I&M Bank Limited

Total Assets: KSh 405.6 billion

Market Share: 5.4%

Diamond Trust Bank Kenya

Total Assets: KSh 399.6 billion

Market Share: 5.3%

Bank of Baroda (Kenya) Limited

Total Assets: KSh 201.9 billion

Market Share: 2.8%

These rankings illustrate the dominance of large Tier 1 banks, which collectively control over

76% of the market share. Strategic expansions, increased deposit mobilisation, and robust

lending practices underpin the sector’s strong performance

Business & Money

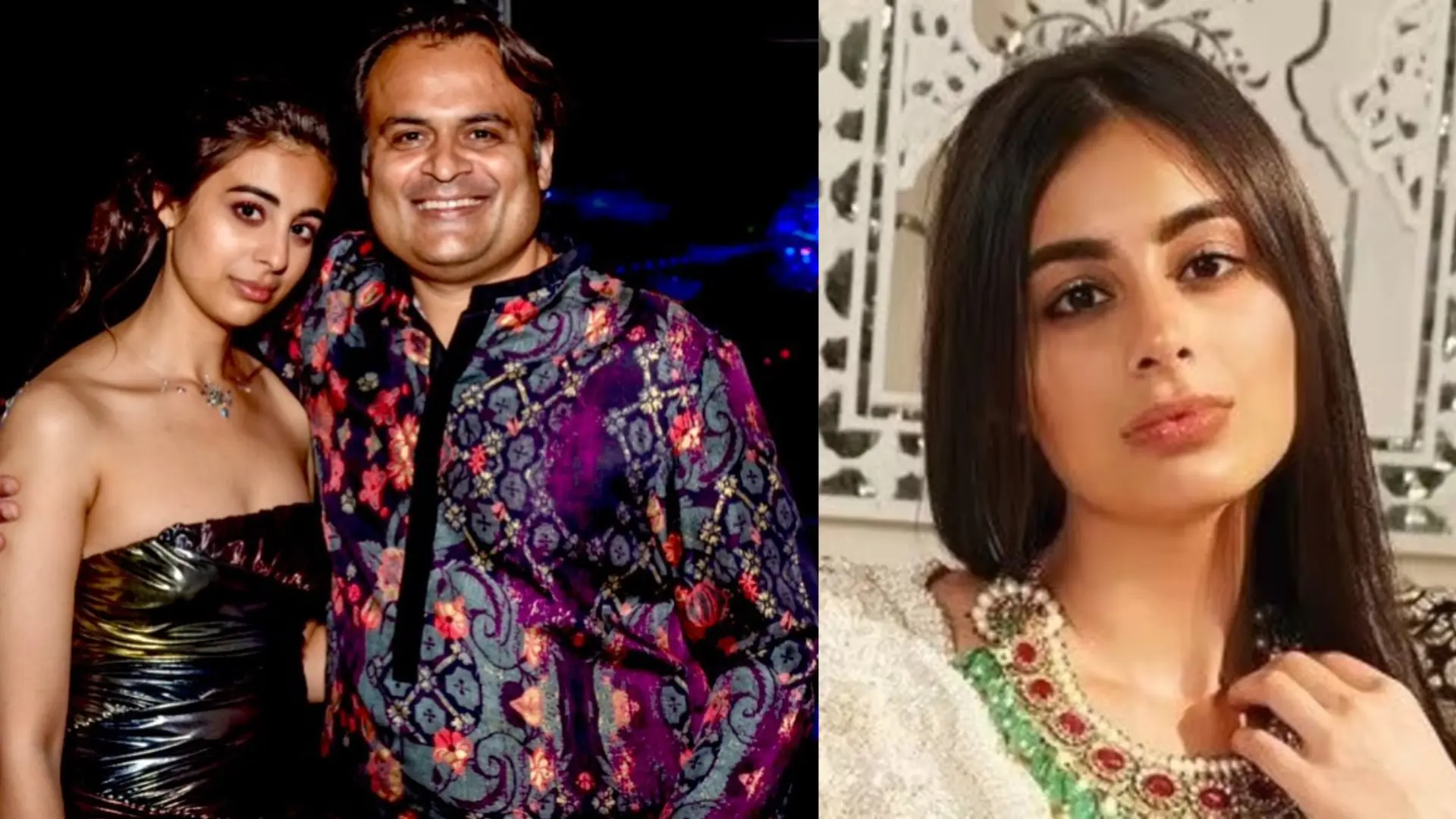

Vasundhara Oswal’s Legal Struggles and Family’s Plea for Justice

: Vasundhara Oswal, daughter of industrialist Pankaj Oswal, faces serious

charges in Uganda. The Oswals call for UN intervention amid claims of corporate

jealousy.

Vasundhara Oswal, the 26-year-old daughter of prominent Swiss-Indian industrialist

Pankaj Oswal, has found herself at the centre of a legal storm in Uganda.

Her father, a well-established business figure, is known for his diverse investments,

most notably a $150 million ethanol plant in Uganda.

This plant, the largest of its kind in East Africa, is a key part of Oswal’s broader strategy

to invest in industrial and eco-friendly solutions in the region. The facility produces extra-neutral alcohol (ENA), which is used in the beverage, cosmetics, and pharmaceutical industries.

It is recognised for its modern technology and sustainable practices, such as zero liquid

discharge, emphasising the Oswal family’s commitment to both industrial growth and

environmental responsibility.

In addition to the ethanol plant, Pankaj Oswal has made strategic investments across

various industries, including petrochemicals, agriculture, and real estate.

His ventures reflect a global reach, extending to Australia and India, where he has

been involved in industries ranging from agriculture to renewable energy.

His diversified business approach and commitment to sustainability have made him a prominent figure in international business. However, in October 2024, the family’s legacy was overshadowed by the legal troubles surrounding Vasundhara Oswal.

She was detained on October 1, 2024, after being accused of involvement in the

alleged murder of Mukesh Menaria, a former employee who had worked with the

Oswals since 2017.

Menaria had accused the family of harassment but later testified under oath that they

had not harmed him Despite this, charges of kidnapping and murder were brought against Vasundhara.

Her family has strongly denied these allegations, claiming that the charges are

politically motivated and part of a larger conspiracy orchestrated by their business rivals

in collaboration with corrupt officials in Uganda.

The Oswals have appealed to the United Nations, seeking intervention and asserting

that the legal proceedings against Vasundhara are unlawful. Vasundhara has actively managed the family business throughout her career, especially the ethanol plant, and led the company’s sustainable initiatives.

Beyond her business involvement, she has also been an advocate for community

welfare and mental health, further cementing the Oswal family’s reputation for corporate

social responsibility.

The unfolding legal drama has raised important questions about the intersection of

business, politics, and the legal systems in Uganda.

While the Oswal family’s ventures reflect a blend of industrial innovation and social

responsibility, the legal challenges Vasundhara faces have cast a shadow over their

business empire, highlighting the complex dynamics at play in East Africa.

-

Business & Money8 months ago

Business & Money8 months agoEquity Group Announces Kshs 15.1 Billion Dividend Amid Strong Performance

-

Politics3 months ago

Politics3 months agoFred Okengo Matiang’i vs. President William Ruto: A 2027 Election Showdown

-

Politics2 months ago

Politics2 months agoIchung’wah Faces Mt. Kenya Backlash Over Gachagua Impeachment Support

-

Politics4 months ago

Politics4 months agoPresident Ruto’s Bold Cabinet Dismissal Sparks Hope for Change

-

Politics5 months ago

Politics5 months agoKenya Grapples with Investor Confidence Crisis Amid Tax Protest Fallout

-

Politics5 months ago

Politics5 months agoPresident Ruto’s Lavish Spending Amid Kenya’s Economic Struggles Sparks Outrage

-

Politics4 months ago

Politics4 months agoJohn Mbadi Takes Over Kenya’s Treasury: Challenges Ahead

-

Business & Money1 week ago

Business & Money1 week agoMeet Kariuki Ngari: Standard Chartered Bank’s new CEO of Africa. What’s Next?